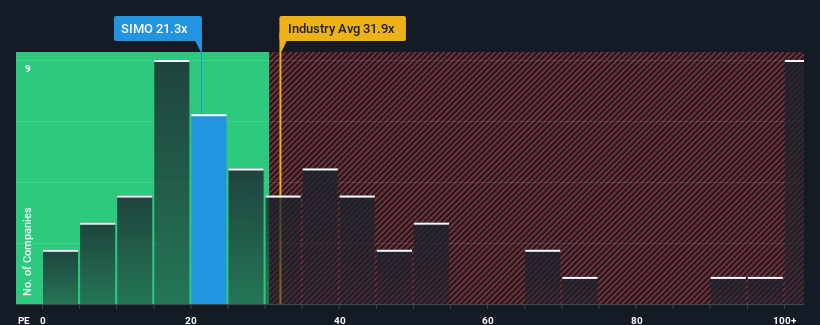

Silicon Motion Technology: High P/E Ratio Challenges Growth Expectations

Silicon Motion Technology Corporation (NASDAQ:SIMO) currently has a price-to-earnings (P/E) ratio of 21.3x. This figure is relatively high, considering that almost half of all U.S. companies have P/E ratios below 18x, and some even trade with P/Es under 10x.

The high P/E ratio might suggest investor optimism, but it’s essential to examine the underlying factors. Generally, a high P/E is justified when a company’s growth potential outshines the market. Analyzing Silicon Motion Technology’s recent financial performance reveals a mixed picture.

Recent Earnings Growth

- Year-over-year: The company experienced a substantial 59% increase in earnings. However, this positive development contrasts with a decline over a longer period.

- Three-year period: EPS decreased by 35% overall.

This indicates that recent earnings growth has not been consistently strong.

Future Outlook

Analysts project that EPS will increase by 15% during the coming year, which is similar to the anticipated 15% growth rate for the broader market. Despite this, Silicon Motion Technology’s high P/E ratio is noteworthy. Investors appear to be setting themselves up for potential disappointment if the P/E ratio adjusts to better reflect the growth outlook.

Key Takeaway

Based on the analysis, Silicon Motion Technology’s P/E ratio seems elevated given that its forecast growth aligns with the market average. Unless the growth outlook significantly improves, the current share price presents a potential risk for investors.

Disclaimer: This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.