Silicon Motion Technology’s Stock: High Institutional Ownership and Recent Market Performance

Silicon Motion Technology Corporation (NASDAQ:SIMO) has recently experienced a 5.4% pullback, adding to a year-long period of losses. This situation has placed a spotlight on the company’s largest shareholders, and some may be considering significant moves.

Key Insights:

- High Institutional Ownership: A substantial portion of Silicon Motion Technology’s stock is held by institutional investors, suggesting their trading activities significantly influence the stock’s price.

- Dominant Shareholder Groups: The top 21 shareholders collectively own 51% of the business.

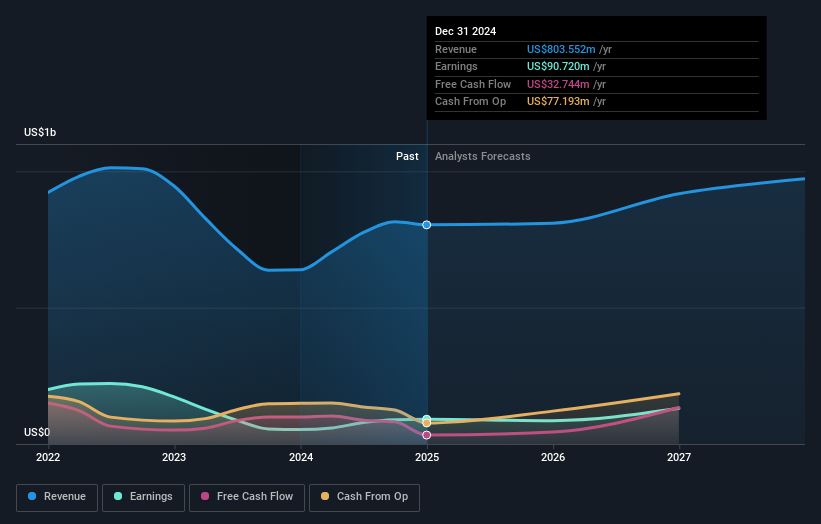

- Ownership Analysis: Research data, alongside analyst forecasts, helps provide crucial insight into the stock’s potential.

Institutional Investors: Who They Are and What It Means for the Stock

Institutional investors hold a significant 83% ownership stake in Silicon Motion Technology, making them the largest, most influential shareholder group. This means they stand to benefit the most from rises in the stock price, but also face the biggest losses when the price falls. Following a US$107 million drop in market capitalization last week, this group of investors is likely concerned, particularly since this loss adds to a 17% decrease over the past year. These investors, often referred to as “liquidity providers,” manage considerable funds, giving them substantial influence over stock price movements.

If the decline in Silicon Motion Technology’s stock price continues, institutional investors could be compelled to sell their shares, which might not be beneficial for individual investors.

Institutional Ownership’s Significance

Many institutional investors use an index that reflects the local market to measure their performance. Often, they focus on companies included in major indices. Given Silicon Motion Technology’s institutional backing, it suggests a degree of credibility among professional investors. Even so, it’s crucial to note that even institutions can make poor investment decisions. It is worth paying attention to potential large-scale sell-offs, which could significantly impact the stock price.

Ownership Structure of Silicon Motion Technology

Institutional investors collectively own more than half the company’s stock, giving them major influence. Hedge funds do not hold a significant number of shares in Silicon Motion Technology. The largest shareholder is FMR LLC, with 6.5% of outstanding shares. The second shareholder holds about 3.9%, and the third holds about 3.8%. CEO Chia-Chang Kou directly holds 1.3% of the shares.

The top 21 shareholders have a combined ownership of 51%, indicating that no single shareholder has definitive control over the corporation. Studying institutional ownership is an effective way for investors to assess a stock’s predicted performance.

Insider Ownership

Company insiders, including board members and executives, hold some shares of Silicon Motion Technology. The ownership of US$58 million worth of shares by insiders (at present prices) typically signals a convergence of interests between shareholders and the board. However, it’s worthwhile to keep track of if insiders are selling their shares.

General Public Ownership

The general public, primarily individual investors, also have a 14% stake in Silicon Motion Technology. While this is a large number, it may not be sufficient to shift corporate policy if the board makes decisions that clash with the other, larger shareholders.

Next Steps

While assessing the different ownership groups is important, other factors deserve close consideration. Investors should also be mindful of associated risks before making decisions.

This article is for informational purposes only and does not constitute financial advice. It is based on historical data and analyst forecasts, and it does not take into account your personal financial situation or investment goals.