Silicon Motion Technology’s Stock Takes a Hit: A Closer Look

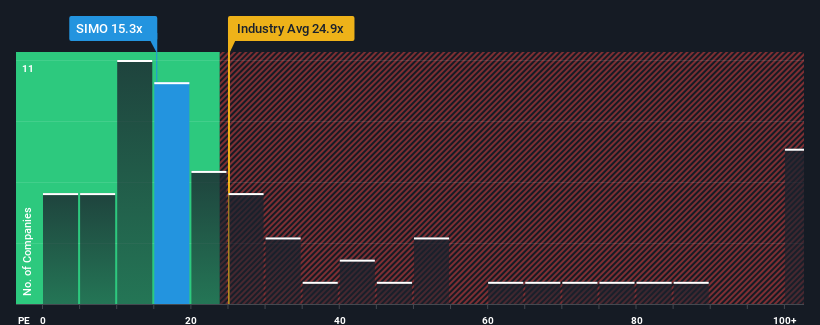

Silicon Motion Technology Corporation (NASDAQ:SIMO) shareholders have faced a significant setback with a 26% share price drop in the last month, continuing a tough year that has seen the share price fall by 49%. Despite this decline, the company’s price-to-earnings (P/E) ratio of 15.3x remains relatively average compared to the U.S. market, which has a median P/E ratio of around 16x.

Recent times have been favorable for Silicon Motion Technology, with earnings rising faster than most other companies. However, the moderate P/E ratio may indicate that investors expect this strong earnings performance to slow down. The company’s earnings per share grew by an impressive 70% last year, but its three-year EPS shrank by 53% overall, indicating inconsistent growth.

Growth Metrics and Analyst Expectations

Looking ahead, the next three years are expected to bring 16% annual growth, according to nine analysts watching the company. This growth rate is significantly higher than the 11% per annum forecast for the broader market. Despite this promising outlook, Silicon Motion Technology’s P/E ratio is currently in line with that of other companies, suggesting that investors may be cautious about the company’s ability to achieve future growth expectations.

The discrepancy between the company’s growth prospects and its current P/E ratio may be attributed to potential risks that are putting pressure on the ratio. Some investors appear to be anticipating earnings instability, which could be offsetting the positive impact of the company’s strong growth outlook.

Conclusion

Silicon Motion Technology’s plummeting stock price has brought its P/E ratio back in line with the market average. While the P/E ratio is not the sole factor in determining whether to buy a stock, it serves as a useful indicator of earnings expectations. The company’s higher-than-market growth forecast, coupled with its current P/E ratio, suggests that potential risks are being factored into the stock’s valuation. Investors should be aware of these factors when considering their investment decisions.

Important Disclosure

This analysis is based on historical data and analyst forecasts, using an unbiased methodology. It does not constitute a recommendation to buy or sell any stock and does not take into account individual objectives or financial situations.