Stock Analysis

SK IE Technology Co., Ltd. (KRX:361610) shareholders are celebrating a positive turn, with the company’s stock price experiencing a 31% surge in the last month, recovering from previous declines. However, this recent increase doesn’t fully offset the 57% drop the stock has seen over the past year. This performance warrants a closer look at the company’s prospects.

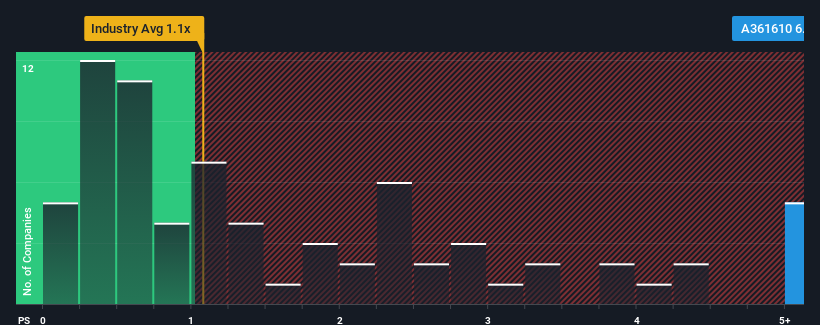

SK IE Technology currently has a price-to-sales ratio (P/S) of 6.6x. This figure is notably higher than the industry average in Korea’s Electrical sector, where many companies have P/S ratios below 1.1x. This discrepancy raises questions about the valuation and whether it’s justified.

Recent Performance of SK IE Technology

SK IE Technology has faced recent challenges, with revenues declining faster than many of its industry peers. This has led to speculation about the potential for a strong revenue rebound which helps to explain the elevated P/S ratio. Investors may be overpaying for the stock if the revenue performance does not improve substantially.

Analysts predict that the company’s revenue will grow by 40% per annum over the next three years, while the industry is only forecasted to grow by 17% annually. This projected growth, along with the expectation of a more prosperous future, helps to explain why SK IE Technology is trading at a higher P/S ratio compared to the industry average. Shareholders appear confident that the company will perform well.

What Does SK IE Technology’s P/S Mean for Investors?

The recent surge in the share price has also driven up SK IE Technology’s P/S ratio. While the P/S ratio should not be the sole factor in investment decisions, it provides insights into revenue expectations. Consequently, the company’s superior revenue outlook is contributing to the high P/S. Investors currently believe the prospects of declining revenues are highly unlikely, which justifies the elevated P/S ratio. The share price is likely to remain strong unless market conditions change.

SK IE Technology engages in the manufacturing and sale of battery materials across South Korea, Asia, and Europe.