Shares of SoundHound AI (SOUN) experienced a significant surge in after-hours trading following the release of its Fiscal Year 2024 fourth-quarter earnings report. The voice AI software company showcased impressive results, exceeding analysts’ expectations on both earnings and revenue.

Earnings per share (EPS) came in at -$0.05, surpassing the consensus estimate of -$0.10. Revenue experienced a substantial year-over-year increase of 101%, reaching $34.5 million. This figure also exceeded analysts’ projections of $33.7 million. Keyvan Mohajer, CEO and Co-Founder of SoundHound AI, credited the company’s performance to notable customer acquisitions and the expansion of partnerships. Some of these key clients include Burger King UK and Lucid Motors (LCID).

SoundHound Updates Guidance

Looking ahead, management has provided updated guidance for Fiscal Year 2025. The company anticipates revenue to fall between $157 million and $177 million, whereas analysts’ consensus was $165.3 million. The expected revenue, with a midpoint figure of $167 million, exceeding consensus, further fueled investor optimism, contributing to the after-hours stock gain.

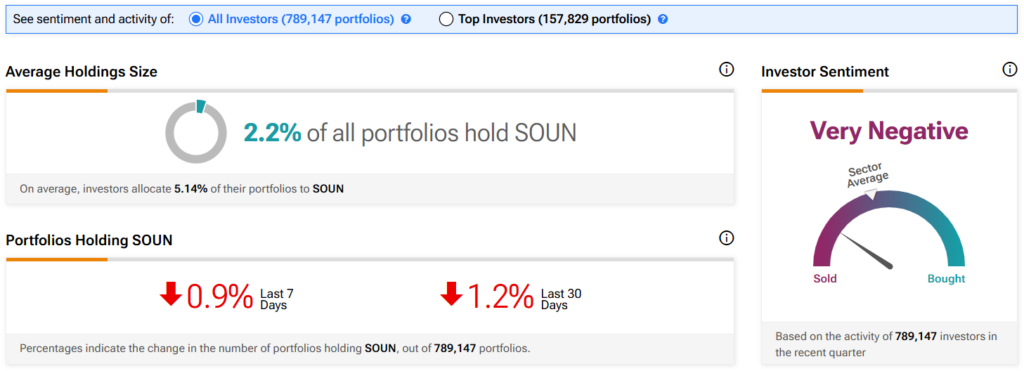

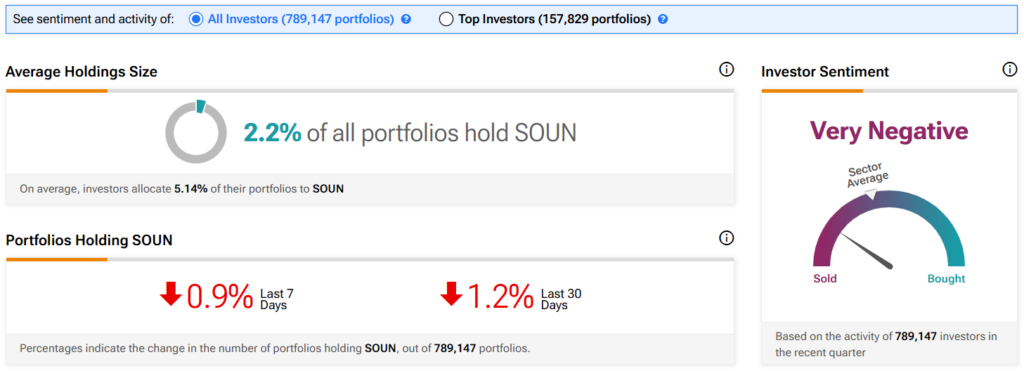

Investor Sentiment for SOUN Stock

Investor sentiment, as tracked by TipRanks, currently reveals a mixed perspective. Of the 789,147 portfolios monitored, 2.2% contain SOUN stock. The average portfolio weighting for those holding the stock is 5.14%, indicating a degree of confidence among these investors. Even so, the number of portfolios holding the stock dropped over the past 30 days, decreasing by 1.2%.

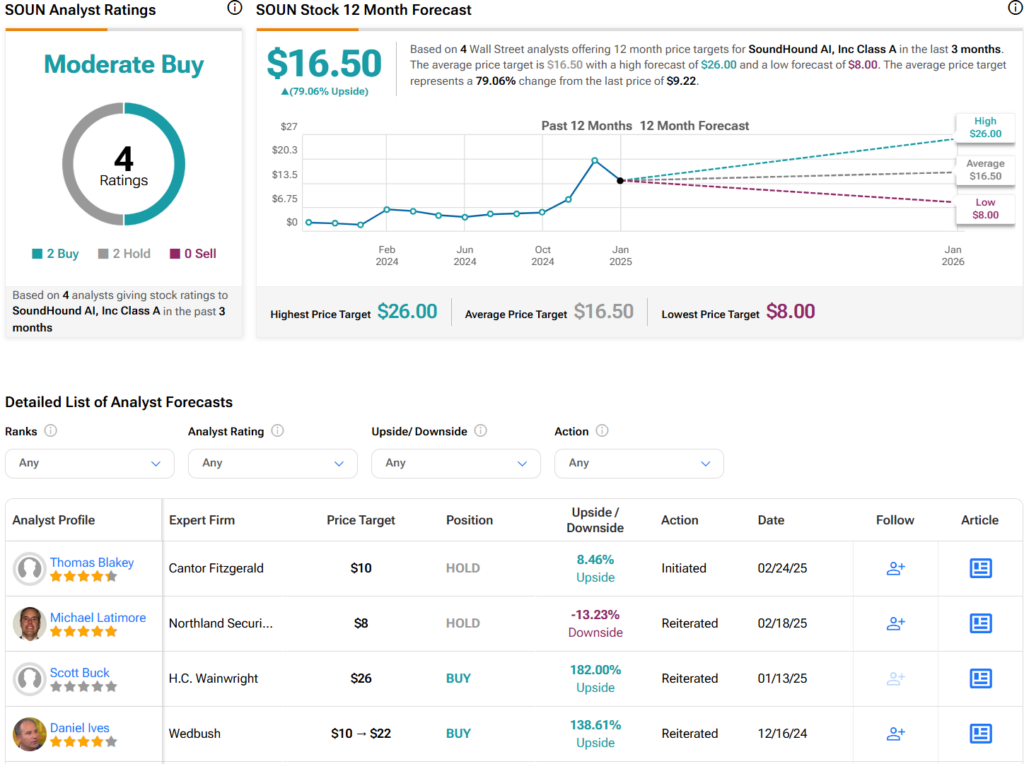

Is SOUN Stock a Good Investment?

Wall Street analysts are currently holding a Moderate Buy consensus rating on SOUN stock, based on two Buy ratings and two Hold ratings assigned in the last three months. Following a 45% increase in its share price over the past year, the average price target for SOUN stands at $16.50 per share, suggesting a potential upside of 79.1%. Note, this projection is subject to revision following the company’s recent earnings report.