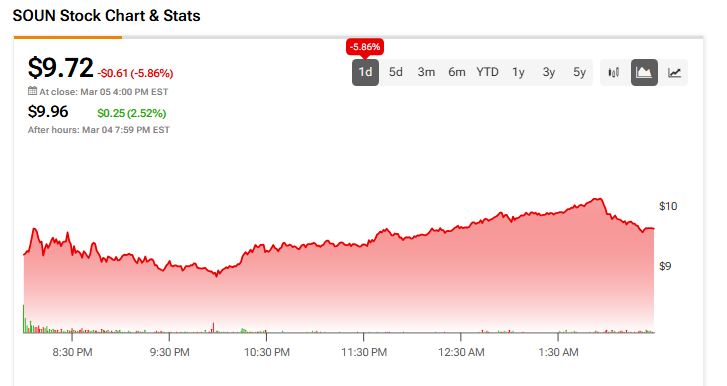

SoundHound AI (SOUN), a company recognized for its voice software, is navigating a period of increased scrutiny. The company’s disclosure of a delay in filing its 2024 annual report has unsettled investors, leading to a 5.9% drop in the stock price, which closed at $9.72 yesterday.

Acquisitions Complicate Financial Reporting

The company attributed the delay to the complexities stemming from its recent acquisitions of Synq3, Inc., and Amelia Holdings, Inc. According to SoundHound, these deals introduced intricate accounting challenges, making it difficult to finalize the report within the original timeframe. However, the company anticipates submitting the report by March 18, 2025, utilizing a 15-day extension permitted under SEC regulations.

Both acquisitions are integral to SoundHound’s growth strategy. Synq3, Inc., acquired for approximately $25 million in the first quarter of 2024, strengthens SoundHound’s footprint in the restaurant voice AI segment. Furthermore, the acquisition of Amelia Holdings, an enterprise AI software firm, for $80 million in August 2024, has broadened SoundHound’s reach across the voice and conversational AI markets.

Internal Control Weaknesses Raise Concerns

The delayed filing is compounded by another challenge: SoundHound has acknowledged “material weaknesses” in its internal controls over financial reporting. These weaknesses point to gaps in the company’s handling of financial data. While SoundHound has indicated ongoing efforts to address these issues, specific details regarding the corrective measures and the expected timeline remain undisclosed. Concerns about such weaknesses can erode investor confidence as they raise questions about the reliability of financial reporting.

Strong Q4 Results Offer a Positive Note

Despite its challenges, SoundHound recently released solid fourth-quarter results on February 27. The company reported revenues of $34.5 million, representing a 101% increase year-over-year. Additionally, earnings per share came in at -$0.05, surpassing the analysts’ consensus estimate of -$0.10 per share. However, for the full year, the net loss widened to $351.1 million, more than tripling the loss from the prior year. This growing loss adds pressure as SoundHound works to resolve its reporting issues.

Ultimately, to regain investor trust, the company must promptly address its internal control issues and ensure transparent, timely reporting.

Analyst Outlook

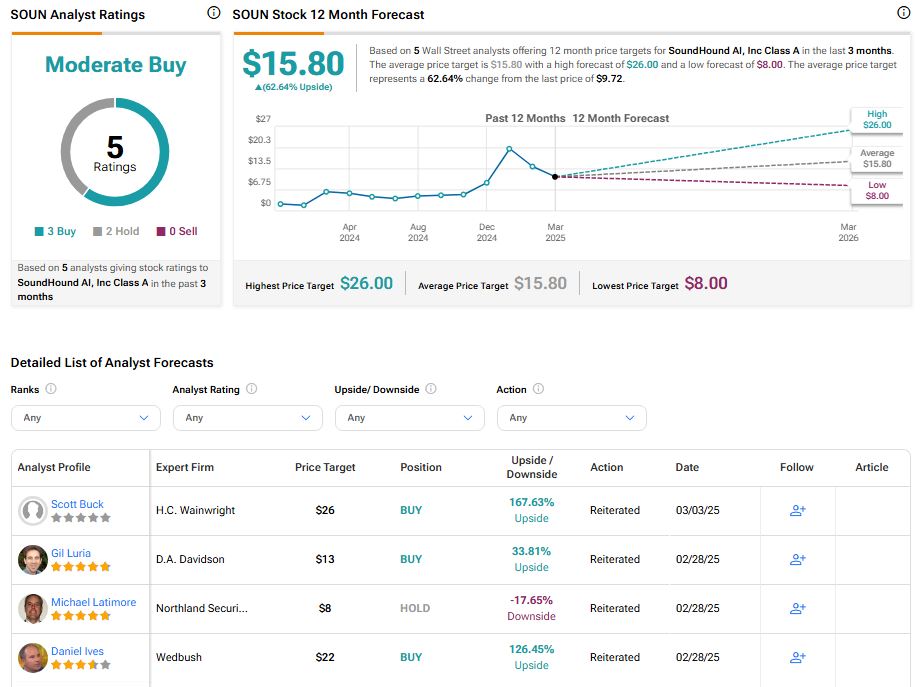

Examining Wall Street’s perspective, analysts maintain a Moderate Buy consensus rating on SOUN stock, based on three Buy ratings and two Hold ratings assigned in the last three months, as illustrated in the graphic.

The average price target for SOUN is $15.80 per share, suggesting a potential upside of 62.64%.