Streamax Technology’s Ownership Structure: Key Insights

After a recent dip in share value, the holdings of Streamax Technology Co., Ltd. (SZSE:002970) CEO Zhijian Zhao have decreased in value by 10%. This analysis examines the company’s ownership structure and how it relates to the recent market performance.

Key Takeaways:

- Significant insider ownership suggests a strong alignment of interests with company expansion.

- The top three shareholders control a majority stake—59%—in the company.

- Analyzing past company performance alongside ownership data provides a solid basis for assessing future business prospects.

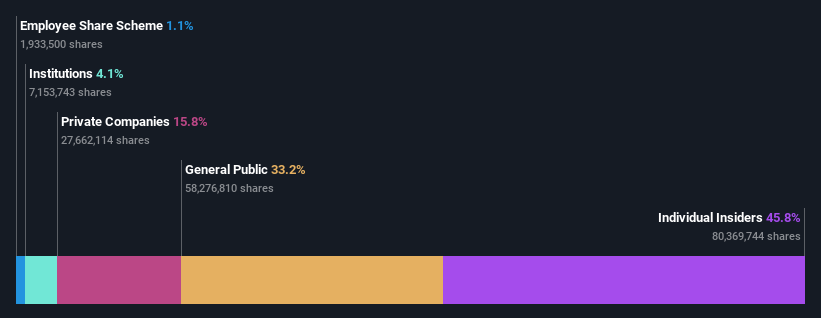

To understand who truly influences Streamax Technology Co., Ltd. (SZSE:002970), focusing on its ownership structure is essential. Notably, individual insiders collectively hold approximately 46% of the company’s shares. This group stands to gain or lose the most from their investment. Following the recent 10% drop in share price, insiders felt the impact most significantly.

Let’s examine each ownership category in detail.

Institutional Ownership

Institutional investors typically benchmark their performance against market indexes, giving them greater focus on companies included in major indices. Institutional investors hold less than 5% of Streamax Technology. This suggests that while some funds are monitoring the company, many have not yet acquired shares.

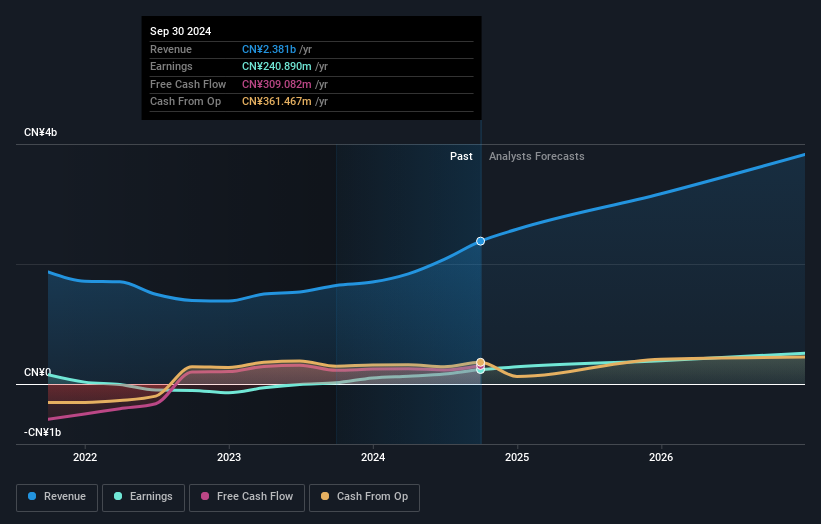

If Streamax Technology continues to see growth in earnings, it may start to attract more attention from these large investors. Substantial share price increases often occur when numerous institutional investors simultaneously acquire stock. While examining the historical earnings trajectory, investors should always keep future performance in mind.

It’s worth noting that hedge funds do not have a significant investment in Streamax Technology.

Major Shareholders

CEO Zhijian Zhao is the largest shareholder with a 25% stake in the company. The second and third-largest shareholders hold 18% and 16% of the outstanding shares, respectively. Furthermore, the second-largest shareholder, Xidian Wang, also serves as a Senior Key Executive, emphasizing a high level of insider ownership among the top shareholders.

Notably, the top three shareholders have a majority ownership stake, giving them substantial influence over the company’s strategic decision-making. While studying institutional ownership can inform investment decisions, it’s also wise to research analyst recommendations for a deeper understanding of a stock’s potential.

Analyst Coverage

There is limited analyst coverage of Streamax Technology, indicating an opportunity for it to gain more attention from the analyst community.

Insider Ownership

For this analysis, the term “insiders” refers to individual insiders, including board members. Though company management runs day-to-day operations, the CEO reports to the board, even when the CEO is a member of that board. A positive sign for investors is often high insider ownership, as this shows the board aligns with the company’s shareholders. However, an excessive concentration of power within this group can also pose risks.

Insiders maintain a significant stake in Streamax Technology Co., Ltd.. They hold a CN¥4.0b stake, which is particularly notable considering the company’s total market capitalization of CN¥8.6b. To check recent insider transactions, investors may wish to review the company’s financial reports.

General Public and Private Company Ownership

The general public, including retail investors, holds a 33% stake in the company. Private companies own 16% of the shares, which may merit more detailed investigation. It’s important to verify any relationships between these private companies and the insiders, especially if those relationships involve undisclosed interests or strategic concerns.

Next Steps

Looking at the ownership structure of a company provides valuable insights. However, a comprehensive analysis requires consideration of other factors.

Disclaimer: This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation and may not factor in the latest price-sensitive company announcements or qualitative material.