Sunrex Technology: Ownership Structure and Recent Performance

Recent analysis indicates that retail investors, who constitute 48% of Sunrex Technology Corporation (TWSE:2387), experienced a 13% gain. Insiders also benefited, showcasing the impact of different shareholder groups.

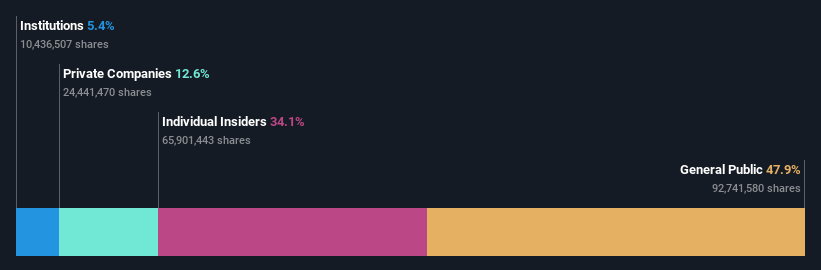

Ownership Overview

Understanding the ownership structure of a company provides crucial insights into its decision-making processes. In the case of Sunrex Technology, retail investors hold the largest share at 48%. This position suggests that public shareholders have a significant influence on the company’s direction, potentially benefiting the most from any upside.

Several key ownership groups are outlined below:

- Retail Investors: 48%

- Top 10 Shareholders: 51%

- Insiders: 34%

Institutional and Insider Involvement

Institutional investors also hold a considerable stake in Sunrex Technology, which implies their analysts have reviewed the stock positively. However, it’s important to note that institutional investments are not foolproof, and sudden shifts in their views could impact share price.

Insiders, defined as company management and board members specifically, collectively hold a 34% stake in Sunrex Technology. This substantial investment, valued at NT$4.8b, represents a strong commitment to the company’s success. It is often viewed positively as it indicates a significant amount of personal investment from those running the business.

Other Ownership Groups

Hedge funds have a small share in Sunrex Technology. The largest individual shareholder is Huo Lu Tsai, with 21% of outstanding shares. The second and third-largest shareholders hold 12% and 4.5% respectively.

Private companies own 13% percent, and while this alone doesn’t provide strong conclusions, further research into the entities behind this share may provide useful insights.

Conclusion

Reviewing ownership details is an essential part of in-depth investment analysis. This comprehensive overview of Sunrex Technology’s share registry can help investors better understand the dynamics at play within the company, and consider how it might respond to market changes. It is beneficial to also consider warnings that have been spotted with Sunrex Technology. Further independent research should always be encouraged.