Sunrex Technology: Retail Investors Benefit from 13% Stock Gain

Recent analysis of Sunrex Technology Corporation (TWSE:2387) reveals that retail investors, holding a substantial 48% stake in the company, benefited significantly from a recent 13% price gain. Insiders also profited, holding 34% of the company’s shares.

This significant retail investor ownership suggests a strong influence on key decisions within the company, reflecting the interests of the broader public shareholder base. The top 10 shareholders collectively possess over half of the share register.

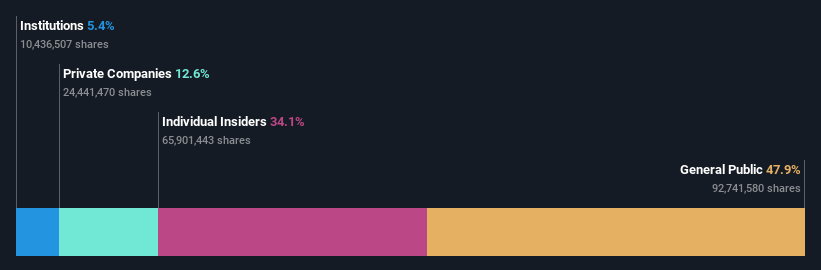

Ownership Structure Insights

- Retail Investors: With 48% ownership, retail investors hold the largest single share. They experienced the most gains following last week’s price increase.

- Insiders: Insiders possess a significant 34% stake, reflecting a considerable investment in the company’s performance.

- Institutional Investors: Institutions hold a considerable stake, indicating that analysts have examined the stock favorably – though like all investors, they may be mistaken. However, a change in institutional sentiment could trigger a rapid price decline.

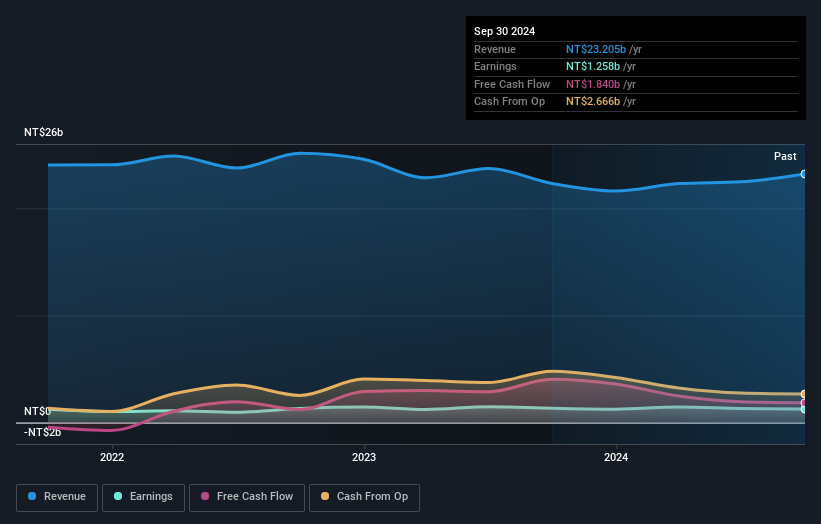

Financial Performance and Future Outlook

While hedge funds have a minimal presence, Huo Lu Tsai is the largest shareholder with 21% of outstanding shares.

It is worth examining analyst sentiment on Sunrex Technology: Our information indicates that they don’t appear to be covering the stock currently, which may contribute to the fact that it remains relatively unknown.

Insider Ownership

Company management runs the business, but the CEO will answer to a board of directors. The amount of insider ownership is generally viewed as a positive sign. Insiders own a combined NT$4.8 billion stake in the NT$14 billion business. It might be worth checking whether those insiders have recently been buying additional shares.

Public and Private Ownership

- General Public: The general public holds a 48% share, influencing how the company operates.

- Private Companies: Private companies own 13% of the outstanding shares. It is worth investigating the entities within those private companies.

Disclaimer: This article is based on data from the last twelve months only. It is for informational purposes and does not constitute financial advice.