Suzhou Anjie Technology: A Closer Look at its Fundamentals

Recently, Suzhou Anjie Technology (SZSE:002635) has seen a 5.6% decrease in its stock price over the past week. This can make investors wonder if there is a buying opportunity or if this trend will continue. Focusing on a company’s financial performance over time can help with determining the best path for investment. This analysis will investigate Suzhou Anjie Technology’s financial performance in context. Specifically, the company’s Return on Equity (ROE) will be examined.

Understanding Return on Equity (ROE)

ROE serves as a key metric for assessing how effectively a company’s management utilizes its capital. Simply put, it reveals the profitability of a company in comparison to shareholder equity. A higher ROE generally indicates better efficiency in generating profits from the equity invested.

Calculating Suzhou Anjie Technology’s ROE

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

Based on this formula and the trailing twelve months up to September 2024, Suzhou Anjie Technology’s ROE is calculated as:

5.0% = CN¥289m ÷ CN¥5.8b

This means that for every CN¥1 of shareholder capital invested, the company generated CN¥0.05 in profit.

ROE and Earnings Growth: What’s the Connection?

ROE gives an efficient profit-generating measurement, and the growth potential of a company is also determined by reinvestment, or “retention,” of its earnings into the company. Companies with high ROE and strong profit retention typically exhibit higher growth rates compared to those with lower figures.

Comparing Suzhou Anjie Technology’s Earnings Growth and ROE

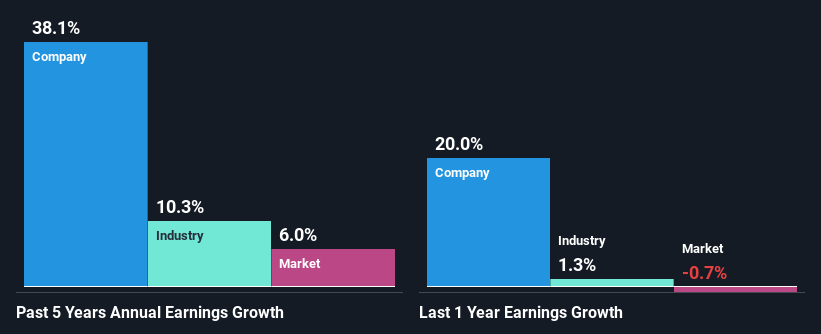

Initially, Suzhou Anjie Technology’s 5.0% ROE doesn’t appear particularly promising. Compared to the industry average of 6.5%, the company’s ROE seems less impressive. However, Suzhou Anjie Technology’s net income grew at a significant rate of 38% over the last five years. This growth is noteworthy. Factors such as a low payout ratio or efficient management might be at play.

Compared to the industry average of 10% in the same period, Suzhou Anjie Technology’s growth is high, showing strong performance.

Earnings Growth: An Important Metric

When valuing a stock, evaluating the earnings growth is crucial. It’s important for investors to assess whether the market has correctly priced in a company’s expected earnings growth or decline. This helps assess the future of the stock. The Price-to-Earnings (P/E) ratio is a useful indicator of the price the market is willing to pay for stock based on its earnings prospects.

Reinvesting Profits at Suzhou Anjie Technology

Suzhou Anjie Technology’s median payout ratio is 59% over three years. This means that the company retains 41% of its income. This indicates that the company has achieved significant earnings growth despite returning most of its profits to shareholders. Moreover, the company has a history of paying dividends for at least ten years, demonstrating a commitment to sharing its profits with shareholders.

Conclusion

Suzhou Anjie Technology presents some positive factors, most notably its high earnings growth. Whether this growth could be even higher with more earnings reinvestment and lower dividend payouts is worth considering. The latest analyst forecasts anticipate this growth rate to continue. Further research is suggested to understand if these expectations base on industry-wide trends, or on the company’s specific fundamentals.