A Zurich-based startup is making significant strides in the burgeoning field of “agentic AI,” having just secured a substantial investment to fuel its growth. Unique announced on Thursday that it has closed a $30 million Series A funding round. The round was led by London-based venture capital firm DN Capital and CommerzVentures, the investment arm of Germany’s Commerzbank.

“Agentic AI” has become one of the most talked-about trends in technology. Despite the lack of a universally accepted definition, the underlying concept is clear: AI agents should be able to do much more than simple chatbots, with the ability to make decisions and perform a wide variety of tasks. These could range from managing online shopping and organizing expense reports to improving efficiency in manufacturing processes.

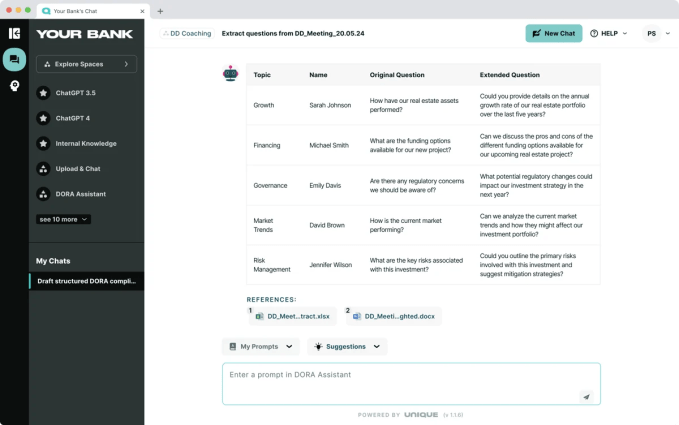

Founded in 2021 by CEO Manuel Grenacher, CCO Michelle Heppler, and CTO Andreas Hauri, Unique aims to create an “agentic AI workforce” for financial services. This includes automating workflows across several key areas, such as research, compliance, and KYC (“know your customer”) processes. Unique offers a range of customizable AI agents. For example, the investment research agent analyzes both internal and external knowledge to provide answers to natural-language queries. There’s also a due diligence agent, which analyzes documents like meeting transcripts and compares them with past evaluations to suggest potential questions for bank personnel.

Initially focused on AI-powered video tools for sales teams, Unique later transitioned to become a “co-pilot for finance teams.” In 2023, the company launched with Swiss private national bank Pictet, which is also counted as a strategic investor. Furthermore, several other major Swiss financial institutions are Unique’s customers as well, including UBP and Graubündner Kantonalbank.

With the recent $30 million in funding, Unique plans to accelerate its international expansion, with a particular focus on the U.S. market. To date, the company has raised a total of $53 million.