Tansun Technology (SZSE:300872) Faces Valuation Questions Despite Recent Stock Surge

Shareholders of Tansun Technology Co., Ltd. (SZSE:300872) have enjoyed a significant reward recently, with the stock price climbing 32% in the past month. This recent rise contributes to a substantial 72% gain over the past year. However, beneath this positive performance, potential investors should carefully consider the company’s current valuation.

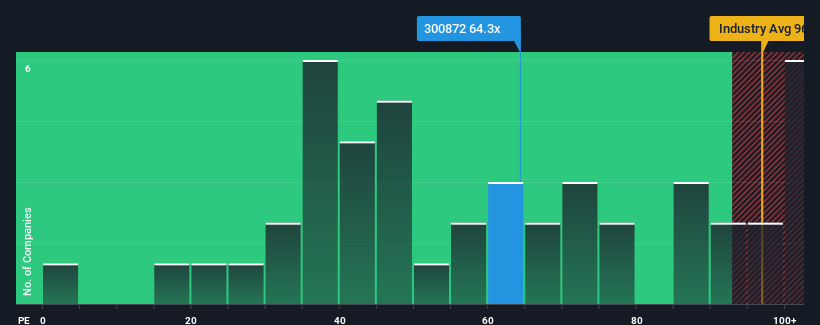

Given that approximately half of the companies in the Chinese market have price-to-earnings ratios (P/E) below 38x, Tansun Technology’s P/E of 64.3x might raise concerns. While a high P/E isn’t always a cause for immediate alarm, it’s essential to understand the underlying factors that may be driving it.

Performance and Market Expectations

One factor contributing to this high valuation could be the company’s recent earnings growth. Compared to the declining earnings experienced by many other companies, Tansun Technology has demonstrated positive growth. This has likely led investors to anticipate continued outperformance, making them more willing to pay a premium for the stock. However, investors should carefully assess whether the company’s future performance can justify the high current price.

To gain a comprehensive view of analyst estimates for the company, a deeper analysis is recommended.

Growth Trends and Future Projections

A company with a high P/E ratio like Tansun Technology’s is generally expected to significantly outperform the market. Looking back, the company’s bottom line saw an impressive 67% increase over the past year. However, this was preceded by a 25% drop in earnings per share (EPS) over the previous three years.

Looking ahead, the one analyst covering the company projects earnings growth of 6.6% over the next year. This is notably lower than the market’s anticipated 37% growth. This discrepancy is noteworthy, especially considering Tansun Technology’s P/E ratio is higher than most other companies. This suggests that investors are bullish on the stock. However, this level of earnings growth may not be sustainable, and its impact on the share price should be addressed.

Understanding the P/E Ratio

Tansun Technology’s P/E ratio has increased, mirroring the recent surge in its stock price. The P/E ratio reflects the market’s perception of the company’s overall financial health. The current forecast is that Tansun Technology’s growth will be lower than the market average. This presents a risk of a potential decline in the share price.

Considering the weaker earnings outlook and slower growth, the high P/E may be a cause for concern. It’s crucial to carefully assess the investment risks involved. Investors are advised to consider any factors that may influence the company’s financial performance, to carefully evaluate its future growth prospects and any potential risks.

This article is for informational purposes only and does not constitute financial advice.