The race for AI supremacy intensified today as Tencent (TCEHY), a leading Chinese technology company, unveiled its new AI model, Hunyuan Turbo S. Tencent’s announcement included a strong assertion that the new model surpasses its competitor, DeepSeek, in terms of processing speed.

According to Tencent, the Hunyuan Turbo S is dramatically faster at answering queries than DeepSeek’s R1. Furthermore, the company’s statement, while somewhat assertive, set itself apart from DeepSeek, describing its performance as superior to other slower models which require “thinking” before responding. While Tencent did not name any other companies in this category, their claim emphasizes the rapid-response capabilities of the new Turbo S.

A Reuters report indicates that, during testing in domains such as reasoning, mathematics, and knowledge, the Turbo S matched the performance of DeepSeek-V3. DeepSeek-V3 is the underlying technology powering DeepSeek’s AI chatbot. Interestingly, this chatbot has surpassed OpenAI’s ChatGPT in app store downloads. Tencent’s approach echoes sentiments made last month by Chinese e-commerce and technology competitor Alibaba (BABA). Alibaba touted the power of its new AI model, Qwen 2.5-Max, claiming superiority over DeepSeek and its U.S. rivals, OpenAI’s GPT-4o (backed by Microsoft (MFST)) and Meta Platform’s (META) Llama-3.1-405B.

This competitive environment highlights the impact of DeepSeek’s emergence in the AI field. DeepSeek positions itself as a provider of low-cost, high-performance AI systems. This strategy has clearly resonated with tech firms, not just in the United States, but also within China itself. The Reuters report also noted that Tencent emphasized the significantly reduced usage costs for the new Turbo S compared to its previous iterations. This cost reduction reflects the pressure exerted by DeepSeek’s open-source and low-pricing strategy on other leading Chinese AI companies to offer more competitive pricing to their own users.

Tencent’s headquarters, a symbol of the company’s ambition in the AI field.

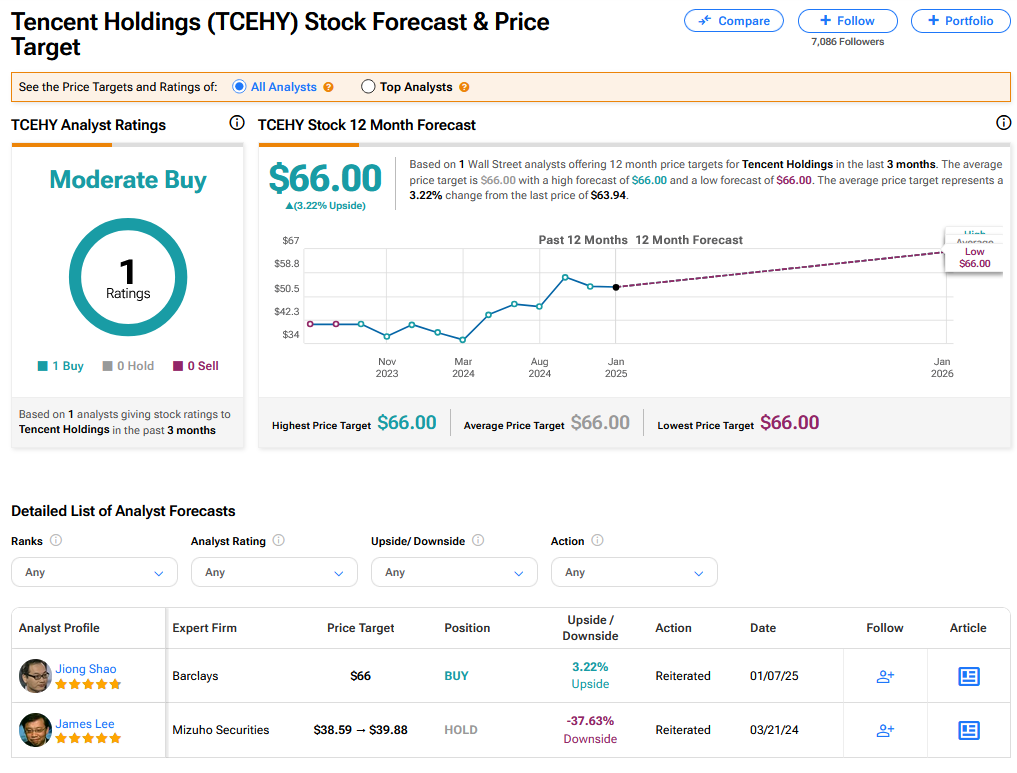

On TipRanks, TCEHY has a Moderate Buy consensus based on 1 Buy rating. Its highest price target is $66. TCEHY stock’s consensus price target is $66 implying an 3.22% upside.