Thalys Medical Technology Group’s Price Appreciation: A Closer Look

Thalys Medical Technology Group Corporation (SHSE:603716) shareholders have reason to be optimistic. The stock has seen a significant jump in price recently, appreciating by 36% over the past month. This surge is a positive development, especially considering that the stock price has also increased by 31% over the past year.

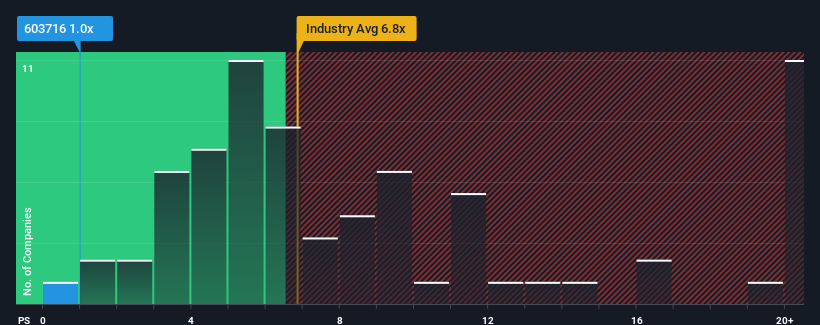

Despite this price increase, Thalys Medical Technology Group’s price-to-sales (P/S) ratio of 1x may appear attractive when compared to the broader biotech sector in China.

Understanding the P/S Ratio

In the Chinese biotech industry, approximately half of the companies have P/S ratios above 6.8x. In fact, P/S ratios exceeding 12x are not uncommon. This comparison suggests that Thalys Medical Technology Group could be undervalued. However, it’s crucial to delve deeper to understand the rationale behind this lower-than-average P/S ratio.

Financial Performance and Revenue Concerns

A key factor to consider is Thalys Medical Technology Group’s recent financial performance. Unfortunately, recent performance has been poor, with declining revenues. This could be a major factor impacting the P/S ratio, as the market may be concerned that the company isn’t keeping pace with industry growth.

For existing shareholders, improvements in revenue performance would be an encouraging sign and may improve the future outlook for the share price.

To gain a comprehensive understanding, a free report on Thalys Medical Technology Group is available to shed light on the company’s historical financial performance, including earnings, revenue, and cash flow.

Analyzing Revenue Growth Trends

To justify its current P/S ratio, Thalys Medical Technology Group needs to demonstrate an average of anemic growth that’s considerably lagging behind the industry average. Looking at the last year, the company’s revenues fell by 8.6%. This decline extends to a longer-term perspective, as revenue is down 27% over the past three years.

Based on these trends, the recent revenue growth has been undesirable. In stark contrast, the rest of the biotech industry is projected to grow by 45% over the next year. This industry outlook underscores the company’s current struggles.

Consequently, it isn’t surprising that Thalys Medical Technology Group trades at a P/S lower than the industry average. However, sustained revenue declines create concern. The shrinking revenue is unlikely to lead to a stable P/S over the long term and could disappoint investors.

If revenue growth doesn’t improve, the potential for the P/S ratio to fall further remains.

Key Takeaways and Outlook

Even after the recent stock price surge, Thalys Medical Technology Group’s P/S ratio remains lower than its industry peers. Because of this, it is important to acknowledge that the price-to-sales ratio can provide insight into overall market perception of a company’s financial health.

Examination of Thalys Medical Technology Group revealed that falling revenues are contributing to its low P/S ratio. In today’s market, shareholders should probably not expect pleasant surprises in future revenue.

Unless there is a meaningful shift in revenue trends, the stock price may not experience significant movement in the near term.

It’s important for investors to understand that there are 3 warning signs for Thalys Medical Technology Group that must be considered before investing. Additionally, investors should research other companies to determine the best opportunity.

Valuation is complex, but deeper analysis can uncover whether the company is undervalued or overvalued with a detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Disclaimer: This article provides general commentary based on historical data and analyst forecasts, and is not financial advice. It does not constitute a recommendation to buy or sell any stock.