The Rise and Fall of Log9 Materials

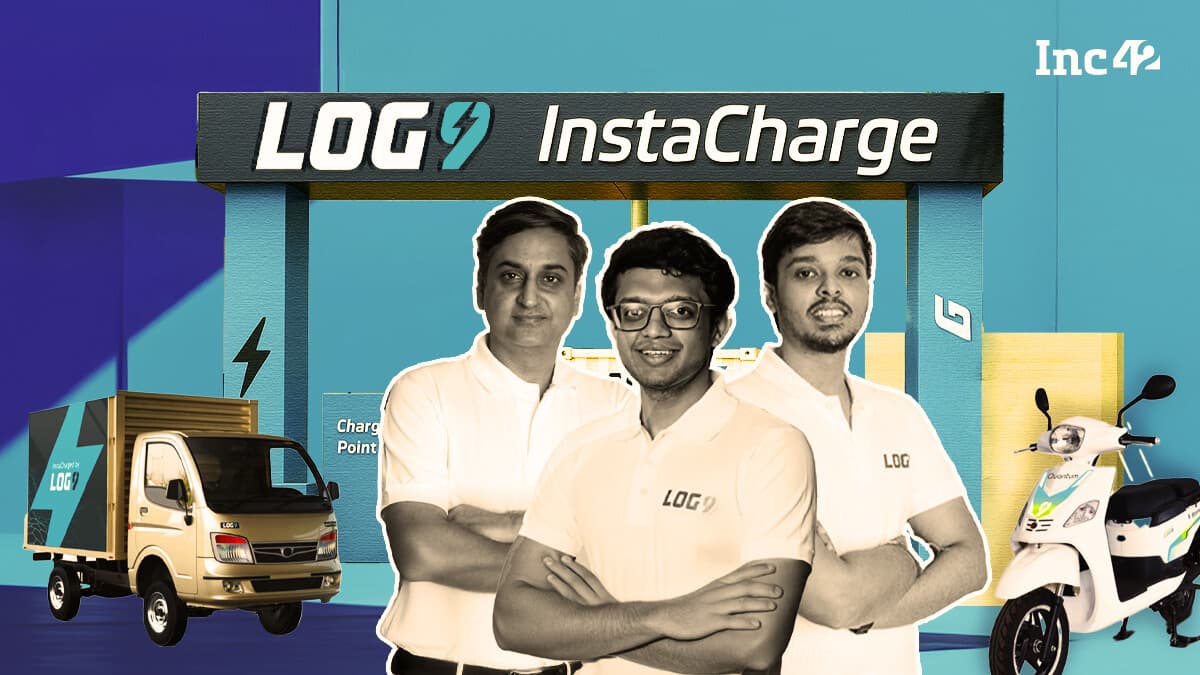

Amidst the recent BluSmart-Gensol controversy, which has reignited debates around startup corporate governance lapses, the downfall of Log9 Materials has flown under the radar. Despite securing over $60 million in funding from venture capitalists and industry heavyweights, the 2015-founded EV startup has struggled to navigate the evolving Indian electric vehicle (EV) battery landscape.

After multiple strategic pivots and technological setbacks, Log9 Materials now finds itself embroiled in legal disputes with customers and grappling with substantial debt. The company’s key decisions, particularly around its battery technology, have been called into question.

Log9 Materials’ story serves as a cautionary tale for EV battery startups operating in India’s rapidly changing market. The company’s inability to adapt to shifting market realities has led to its current predicament, raising important questions about corporate governance and strategic decision-making in the startup ecosystem.

As the Indian EV market continues to evolve, the Log9 Materials case highlights the importance of agility, robust corporate governance, and prudent decision-making for startups operating in this space. The company’s experience serves as a valuable lesson for entrepreneurs, investors, and industry stakeholders alike.