The cryptocurrency industry is experiencing a complex interplay of influences from the United States and China. While the US prioritizes regulation and oversight, China is making substantial investments in artificial intelligence, which is poised to shape the future of AI-driven crypto projects.

Challenges to AI Development in the US Crypto Sector

Since the Trump administration, research agencies in the US, specifically those involved in AI, have faced increasing challenges. One significant action impacting AI development was the layoff of personnel from the National Science Foundation (NSF), which included researchers with expertise in artificial intelligence. These cuts have hindered progress, including the potential for advancements similar to technologies like ChatGPT.

The NSF’s Technology, Innovation, and Partnerships Bureau, which distributes grants for AI projects, was also affected. The postponement or cancellation of review committees has disrupted funding for several AI initiatives. These decisions, and others made during this period, present risks to innovative companies in the sector and create opportunities for China to gain a competitive edge in AI technology.

Gregory Allen, director of the Wadhwani AI Center, pointed out that a large number of highly qualified employees at US AI companies have participated in NSF-funded research. He stated that these cuts are “rob[bing] the future to pay for the present.” Many experts like Geoffrey Hinton have argued that these actions hinder U.S. scientific organizations. Elon Musk has responded by pledging to rectify these mistakes.

China’s Advancement in AI Technology

In contrast to the US, China continues to make advancements in AI technology. Reflecting this trend, the Chinese startup Monica, founded by former Google and Tencent employees under the leadership of Xiao Hong, recently launched a new AI model called Manus on March 6. This followed the global success of AI startup DeepSeek.

Hong describes Manus not as a typical AI chatbot but as a general AI agent designed to bridge thought and action. Manus can manage tasks in both work and daily life settings. The capabilities of Manus generated significant attention when Peak Ji Yichao, a co-founder of Manus, shared a demonstration of its capabilities on X, which demonstrated Manus’s ability to think, plan, and complete tasks independently.The video exhibited Manus’s workflow, including interaction with the environment, web browsing, data collection, and the completion of tasks, such as generating travel plans, conducting stock analyses, and aiding teachers by creating interactive school announcements.

Manus can quickly review job applications with a human-like perspective. Monica claims Manus outperforms OpenAI’s Deep Research based on GAIA criteria. However, Manus is currently in an invitation-only trial phase. The developers are addressing server issues and incomplete task execution, and have not set a public release date.

The Future of AI in Cryptocurrency

The future of cryptocurrency projects leveraging artificial intelligence holds significant promise as they optimize processes and enhance performance within the technology sector. As AI technologies become more adopted, these projects will automate and streamline cryptocurrency processes. They will also create more accurate predictive models, aiding in fraud detection and enhancing transaction security.

This climate fosters competition between the US and China. China continues to make major strides in AI and cryptocurrency technology. In comparison, the U.S. is working to solidify its dominance in this field. However, resource-cutting policies at research agencies like the NSF have alarmed experts regarding the ability to sustain and develop domestic AI projects. This may create a growing gap between the two countries in AI development and its applications in cryptocurrency, creating opportunities for Chinese projects to dominate the global market. The future of crypto AI projects will depend on innovation capacity, strategic investments, and international collaboration.

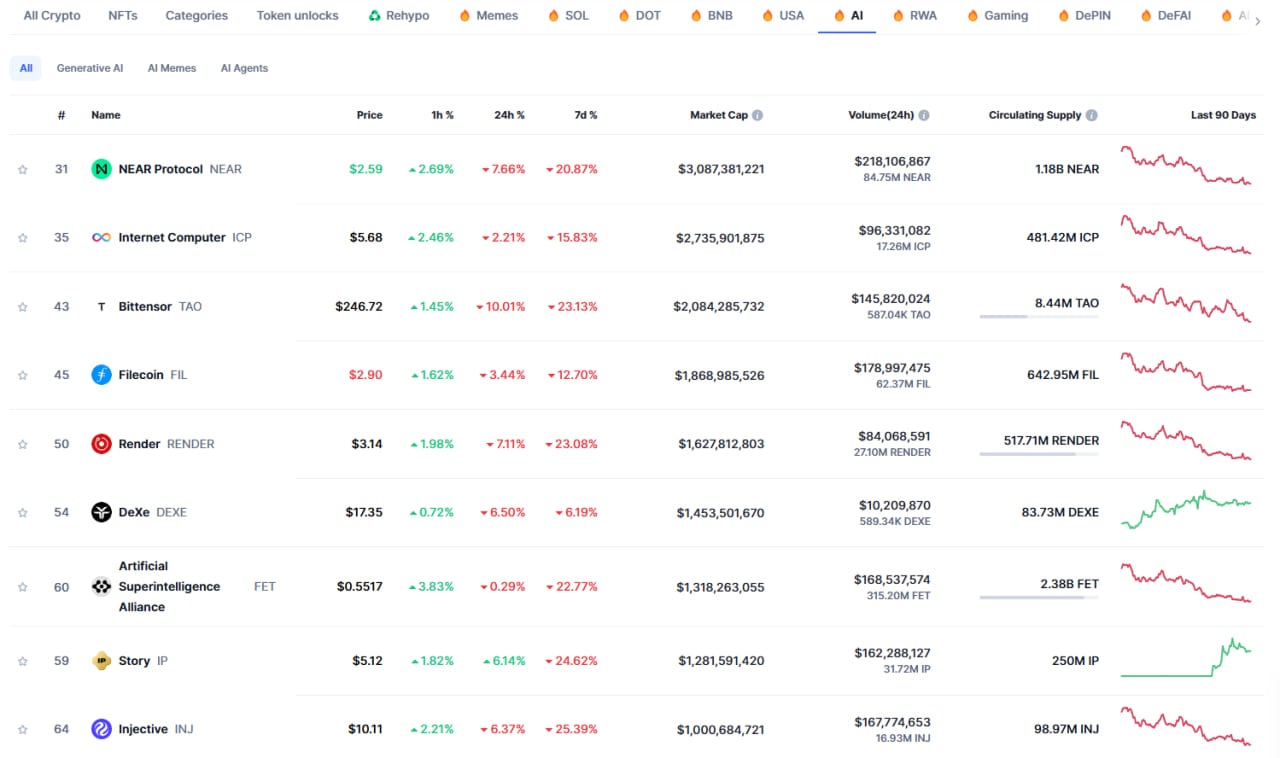

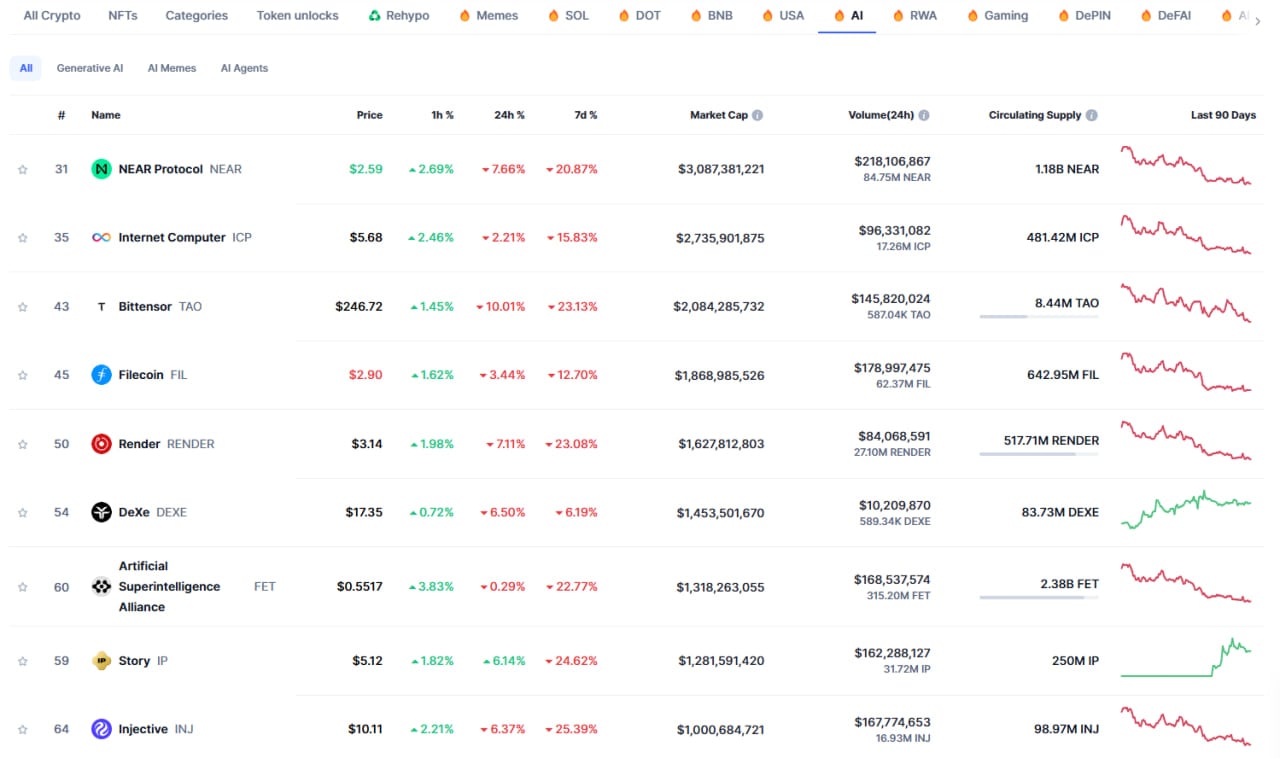

Currently, the market is undergoing adjustments, with several weeks of price declines. Cryptocurrency projects are not experiencing the growth that was once anticipated. However, the low price range may be an opportunity for investors interested in this sector.