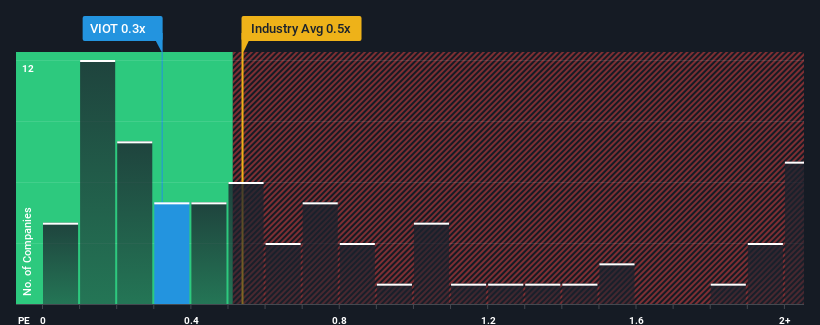

Viomi Technology Co., Ltd (NASDAQ:VIOT) shareholders have faced a challenging month, with the stock price dropping 34% and undoing previous gains. Despite this decline, the stock’s price-to-sales (P/S) ratio stands at 0.3x, which is relatively moderate compared to the Consumer Durables industry average of 0.5x in the United States.

Recent Performance and Revenue Trends

The company’s recent performance has been underwhelming, with a 15% decrease in revenue over the last year, and a total decline of 60% over the past three years. This trend has likely contributed to shareholder dissatisfaction. However, analyst forecasts suggest a potential turnaround, with an expected 13% revenue growth in the coming year, outpacing the industry’s 4.7% growth forecast.

Price-to-Sales Ratio Analysis

Implications for Investors

Following the recent share price tumble, Viomi Technology’s P/S ratio is closely aligned with the industry median. While the price-to-sales ratio alone is not a definitive indicator for investment decisions, it provides valuable insights into the company’s future prospects. The discrepancy between the company’s superior revenue outlook and its P/S ratio suggests potential uncertainty around these forecasts.

Key Considerations

Investors should be aware of the 2 warning signs for Viomi Technology that have been identified. Companies with a history of strong earnings growth and reasonable P/E ratios may be considered safer investments. For those interested in trading Viomi Technology, platforms like Interactive Brokers offer competitive services.

As the situation develops, it will be crucial to monitor whether Viomi Technology can achieve its forecasted revenue growth and how this impacts the stock’s performance.