Streamlining Business Operations with Stablecoins

Stablecoins represent a strategic opportunity for banks and fintechs to enable a fiat-denominated store of value and more efficient cross-border money movement into and out of emerging markets. The circulating stablecoin supply has seen significant growth, with a 46% year-over-year increase to $217 billion. Adjusted transaction volume has also surged by 63% to $6.4 trillion.

Creating a Stablecoin Strategy with Visa

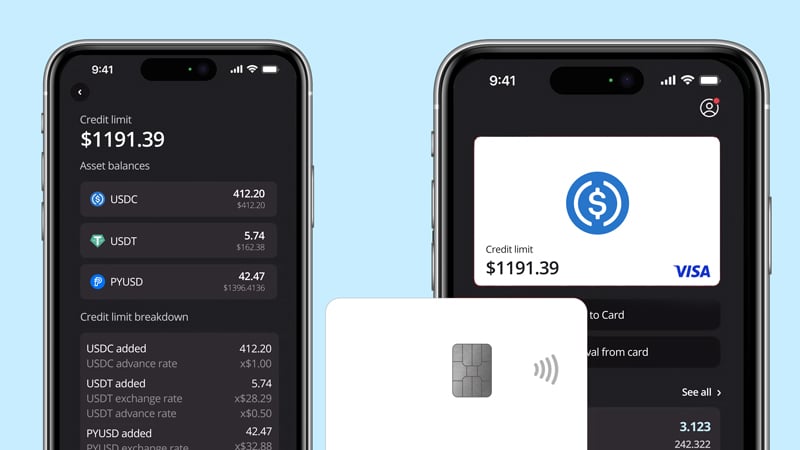

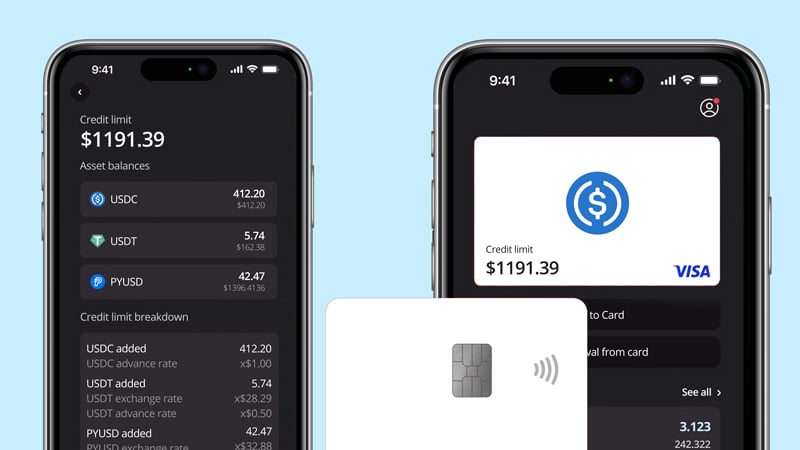

Visa partners with financial institutions to help integrate stablecoins into their strategies. This collaboration enables the enhancement of digital wallets and payment features, as well as the introduction of stablecoin-linked cards. These cards allow customers to make purchases with stablecoins across the vast Visa merchant network.

Key Benefits of Stablecoins

- Stablecoin-linked Cards: Enable consumers to spend their stablecoin balance at over 150 million Visa-accepting merchant locations worldwide.

- Cross-border money movement becomes faster and more cost-effective, particularly in emerging markets.

- The Visa Tokenized Asset Platform (VTAP) allows clients to mint, burn, and transact in stablecoins seamlessly.

Leveraging Stablecoins for Improved Customer Experience

Stablecoins provide banks with a fast and cost-effective alternative to traditional wire transfers in emerging markets. The always-on infrastructure of stablecoins is a significant advantage for financial institutions aiming to grow their customer base and enhance their services.

Use Cases for Stablecoins

- Remittances: Consumers can use digital wallets to make payments in emerging markets efficiently.

- Business Payouts: Businesses can make cross-border payouts to creators, contractors, and freelancers using stablecoins.

- Dollar Store of Value: Consumers and businesses can store value in more stable assets using stablecoins.

- Tokenized Assets: Stablecoins enable banks to replace manual systems with smart contracts, offering next-generation financial solutions.

Visa continues to integrate stablecoins with its global network, providing various solutions such as stablecoin-linked cards, seamless on and off-ramps, and stablecoin settlement. Financial institutions can explore these opportunities by partnering with Visa.