The artificial intelligence (AI) revolution has catapulted semiconductor stocks to the forefront of the market, with Nvidia being a prominent beneficiary. However, as a long-term investor, it’s essential to look beyond the mainstream names. Advanced Micro Devices (AMD), despite a 31% share price decline over the last year, presents an intriguing opportunity. AMD’s data center business is making significant strides in the AI chip landscape, directly competing with Nvidia. The company’s data center segment has shown impressive revenue growth, with a year-over-year increase of 80% to 122% over the past four quarters. Moreover, AMD has nearly doubled its operating income in the chip business while maintaining high double-digit sales growth.

AMD’s Data Center Business: A Key Growth Driver

AMD’s data center financials reveal a promising trend. Revenue for the data center segment has grown steadily, reaching $3.7 billion in Q1 2025, with operating margins expanding to 25%. Although there may be concerns about a slowdown, it’s essential to consider the cyclical nature of the semiconductor industry and the impact of Nvidia’s new GPU architecture launch. AMD is set to launch new architectures later this year, with CEO Lisa Su expressing confidence in their potential success.

Notable Customer Wins and Partnerships

A significant factor driving AMD’s future growth is its ability to secure notable customers. Microsoft, Oracle, and Meta Platforms are utilizing AMD’s MI300 accelerators alongside Nvidia GPUs. Amazon, another Nvidia customer, has made a strategic investment in AMD, potentially paving the way for partnership opportunities between AMD and Amazon’s cloud infrastructure business.

Is AMD Stock a Buy?

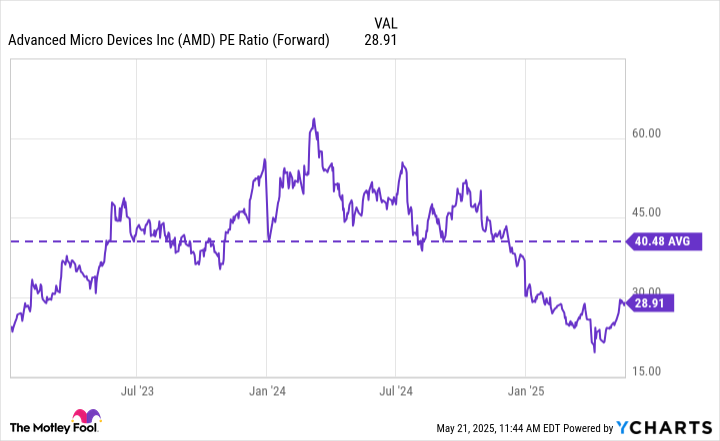

As the AI infrastructure spend continues to rise, AMD is well-positioned to capitalize on this trend. With its data center business driving revenue growth and margin expansion, AMD stock offers an attractive investment opportunity for those willing to look beyond the current market sentiment.