Investors are currently navigating a market correction, and many are trying to decide if it’s a buying opportunity. A correction, defined as a 10% decline from an index’s all-time high, isn’t as extreme as a bear market, but it still prompts careful consideration. Instead of viewing stocks as a blanket buy or sell, I’m focusing on specific companies. Two stocks that I’m still avoiding, even after the recent sell-off, are Apple (AAPL) and Palantir Technologies (PLTR). While both are popular, their valuations still appear too high for me.

Apple: Expensive Even After the Dip

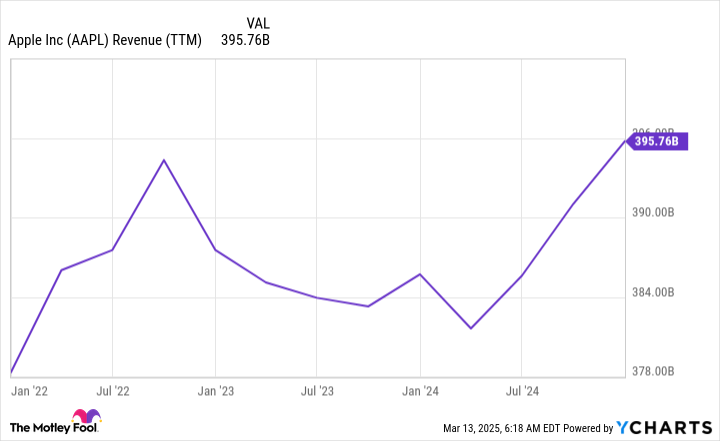

Apple, a global brand powerhouse, has created a strong ecosystem around its iPhones. However, I’m hesitant to buy into it right now. The company hasn’t launched a truly groundbreaking product in recent years, and its sales have been flat since 2022.

Apple’s revenue, though trending up, is projected to grow by only 4.6% in fiscal year 2025.

This growth rate barely outpaces inflation. For example, Apple’s revenue of $378 billion in January 2022 equals $424 billion in December 2024, according to the U.S. Bureau of Labor Statistics. This suggests Apple’s growth hasn’t kept up with inflation over the past three years.

Apple’s valuation also remains high compared to its peers and the overall market.

Apple’s forward earnings multiple is nearly 30, significantly above its historical average for the past two years.

This is nearly 50% higher than the S&P 500’s multiple of 21.2. While Apple’s brand deserves recognition, the projected growth rate is below the S&P 500’s average (10%). This is a major red flag. Moreover, other members of the ‘Magnificent Seven’ such as Alphabet, Meta Platforms, and Nvidia, are valued at lower multiples despite exhibiting faster growth. Their recent quarterly revenue growth figures were 11.8%, 20.3%, and 77.9%, respectively. In short, Apple’s high price tag makes its stock less appealing.

Palantir: Growth Isn’t Enough

Palantir presents a stark contrast to Apple in terms of growth. The company’s AI-driven data analytics software is used by both government and commercial clients. Due to demand, revenue growth is accelerating, making it one of the hottest stocks on Wall Street.

Palantir’s revenue grew by 36% in the first quarter

Management indicates a 36% growth rate for revenue in Q1. Given Palantir’s history of underpromising and overdelivering, expect that rate could reach 40% when they report their first-quarter results. Even with this strength, Palantir’s stock has dropped over 30% from its all-time high. But even with that significant drop, it still doesn’t justify the stock price.

Even under extremely optimistic growth scenarios–revenue growing at 40% annually over the next four years, resulting in $11 billion in revenue by that point–Palantir’s stock would still trade at 59 times forward earnings. That multiple is very high, especially considering that the stock price would need to remain unchanged over the next four years to fulfill this projection. Given the growth already factored into Palantir’s stock price, a further and significant decline is needed before I’d consider buying.