Why Lite-On Technology Corporation (TWSE:2301)’s Dividend Might Not Be the Best Investment Right Now

Regular investors understand the appeal of dividends. However, it’s important to assess the sustainability of dividend payments and the overall health of the company. With Lite-On Technology Corporation (TWSE:2301) about to trade ex-dividend, it’s a good time to examine whether its upcoming dividend is a sound investment.

The ex-dividend date, typically two business days before the record date, is the cutoff for receiving the dividend. To qualify for the dividend, investors must own Lite-On Technology shares before March 20th. The company will then pay the dividend on April 25th.

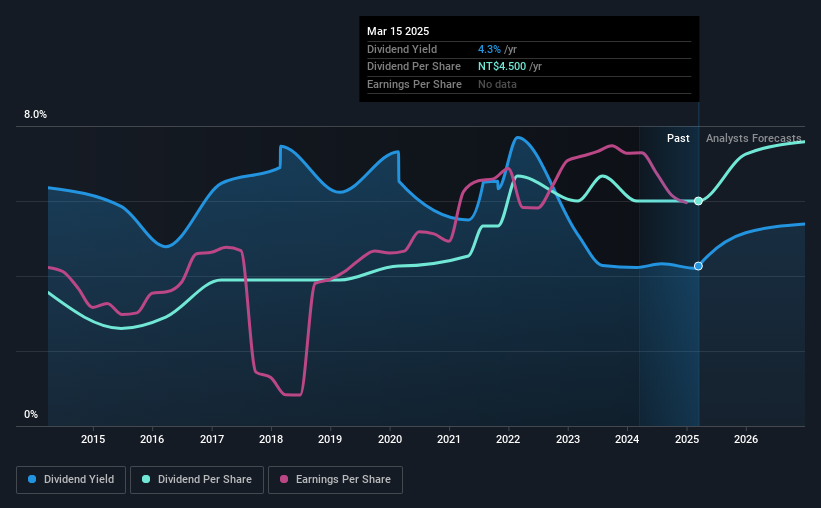

Lite-On Technology’s upcoming dividend is set at NT$2.506595 per share. Over the past year, the company distributed a total of NT$4.50 per share. Based on this, Lite-On Technology has a trailing yield of 4.3% relative to the current stock price of NT$105.50.

While dividends are attractive, it’s essential to make sure they are sustainable. This involves looking at the company’s payout ratio and its growth prospects.

Is the Dividend Sustainable?

Dividends are usually paid from company profits. If a company pays out more than its earnings, the dividend is at risk. Lite-On Technology has a dividend payout ratio of 86% of profit, meaning a significant portion of its earnings are being distributed. This limited reinvestment could potentially slow future earnings growth. Also, an examination of the free cash flow is needed.

Lite-On Technology paid out 123% of its free cash flow as dividends in the past year, which is a cause for concern. The company has a large net cash position, yet it’s wiser to assess dividends relative to cash flow and profit generation. Paying dividends from cash reserves isn’t a long-term solution. The company reported a profit, but didn’t generate enough cash, which could jeopardize future dividends.

Earnings and Dividend Growth

Companies with strong growth prospects often make the best dividend payers. Lite-On Technology’s earnings per share have grown at an average of 5.2% over the last five years, which is encouraging. However, the dividend payments consumed most of the company’s cash flow over the past year. Lite-On Technology has increased its dividend by around 5.4% per year over the last decade.

Final Thoughts

Lite-On Technology is distributing a significant percentage of both its income and cash flow as dividends. The combination is not very attractive from a dividend perspective. While earnings per share have been growing, a higher payout ratio and negative cash flow make this less appealing. Given these factors, investors might want to hold off on purchasing the stock for now. Investors should be aware of the warning signs involved with this stock.

Disclaimer: This analysis is based on historical data and analyst forecasts and is not financial advice.