As the stock market closed on April 22, all ‘Magnificent Seven’ stocks showed negative price returns in 2025. Microsoft (MSFT 2.31%) and Meta Platforms (META 4.30%) have fared relatively better than their peers, with drops of 13% and 14.5%, respectively. Both companies are scheduled to report their first-quarter 2025 earnings on April 30. Let’s examine why these tech giants could be attractive investments despite current market turbulence.

Potential Challenges for Microsoft and Meta

One significant challenge facing both Microsoft and Meta is the potential impact of new tariff policies on their AI infrastructure investments. These companies are spending billions on AI development, including Nvidia chips, custom silicon engineering, and data center expansions. The complexity of tariff regulations could lead to increased costs for these investments. Moreover, corporations might scale back spending on cloud computing, cybersecurity, and advertising, which could slow sales growth for both Microsoft and Meta. A combination of rising costs and slowing sales could negatively impact their profitability.

Mitigating Strategies and Investor Concerns

To counteract potential profit declines, Microsoft and Meta might need to adjust their AI capital expenditure plans. However, this could disappoint investors who are counting on AI-driven growth. The key question is whether these companies can balance short-term financial pressures with long-term growth strategies.

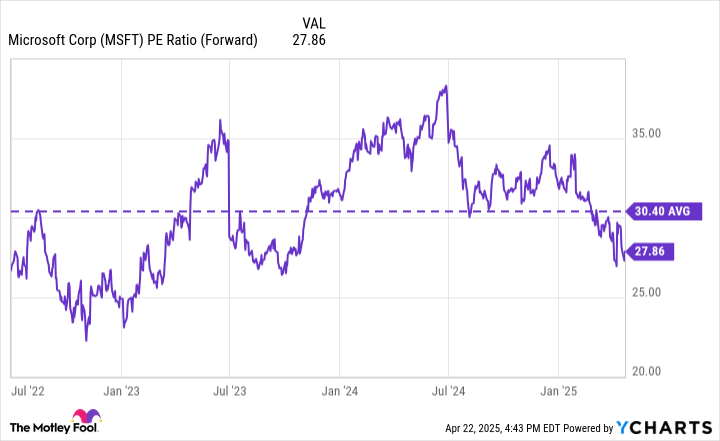

Why Microsoft Remains Attractive

Why Meta Platforms Holds Potential

Long-Term Perspective

Investors should keep in mind that tariff policies can change, and economic slowdowns are typically temporary. The current sell-off in growth stocks presents an opportunity to invest in companies like Microsoft and Meta at reasonable valuations. By taking a long-term view, investors can potentially benefit from the resilience and growth potential of these technology leaders.