Broadcom’s Recovery Amidst Tariff Uncertainty

The announcement of new tariffs by President Donald Trump on April 2 has led to significant stock market volatility, particularly affecting technology stocks. The Nasdaq Composite fell 7.5% as of April 18 following the tariff news. Broadcom (AVGO 2.21%), a semiconductor company, initially saw its shares drop by as much as 20% before recovering to less than 1% decline at the time of writing. A significant factor in this recovery was the company’s recent announcement of a stock buyback program worth up to $10 billion through December 31.

Secular Tailwinds in AI Infrastructure

Despite near-term challenges posed by tariffs, Broadcom’s future appears promising due to its involvement in the artificial intelligence (AI) industry. Cloud hyperscalers such as Microsoft, Amazon, and Alphabet are expected to spend nearly $260 billion on AI infrastructure in 2025 alone. Broadcom already works with some of these hyperscalers, positioning it well for the growing demand in networking and custom silicon services. Additionally, Meta Platforms plans to increase its capital expenditures by 67% this year, potentially spending up to $65 billion, with a focus on designing its own silicon in collaboration with Broadcom.

Why Now Is a Great Time to Invest

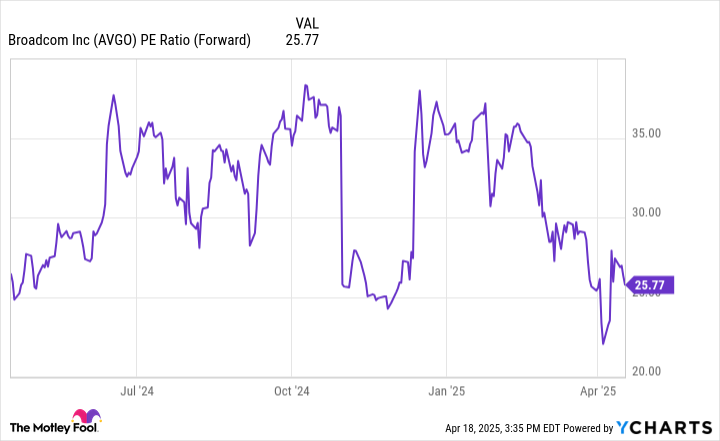

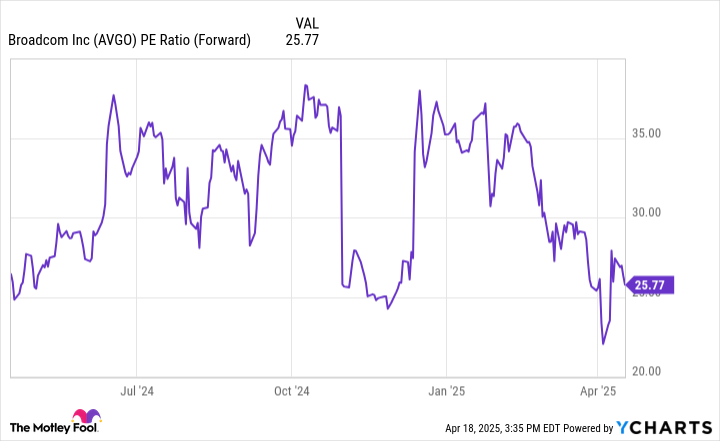

Although Broadcom’s stock has recovered somewhat, it remains down 26% for the year. The ongoing sell-off has compressed the company’s valuation to its lowest level in about a year based on forward price-to-earnings (P/E) multiple, as shown in the chart above. The recent stock buyback announcement can be seen as management’s confidence in the stock being undervalued. With the buyback program set to continue through the end of the year, and considering Broadcom’s robust prospects due to increased infrastructure spending by AI leaders, the stock appears to be a bargain at current levels. Despite near-term volatility from tariffs, this presents an opportunity to invest in a leading AI growth stock.