Win Win Precision Technology (TWSE:4949) Shows Positive Momentum, But Concerns Linger

Shareholders of Win Win Precision Technology Co., Ltd. (TWSE:4949) are likely pleased with the stock’s recent performance. The share price has experienced a significant surge, climbing 45% over the past month. However, a closer look at the company’s fundamentals reveals a more complex picture.

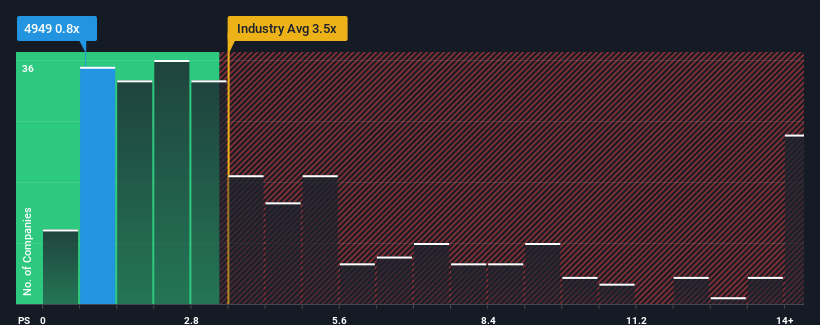

Despite the recent gains, the stock is still down 23% over the last year. Furthermore, the company’s price-to-sales (P/S) ratio of 0.8x appears low compared to the broader Semiconductor industry in Taiwan. Half of the companies in this sector have P/S ratios above 3.5x, and ratios above 8x are not uncommon. While the P/S ratio might suggest the stock is undervalued, this may be misleading.

Recent Performance and Revenue Decline

A significant factor in evaluating Win Win Precision Technology is the company’s declining revenue. This raises questions about the market’s perception of its ability to compete within the industry, potentially contributing to the low P/S ratio.

To gain a deeper understanding of the company’s financial performance, a free report on Win Win Precision Technology provides a comprehensive overview of it’s historical performance.

The company’s revenue declined by 53% last year. Over the last three years, the company’s revenue has decreased by 11% overall. This revenue contraction is undesirable when compared to the rest of the industry. The rest of the industry is expected to grow by a significant amount in the next year.

Given these trends, it is understandable that Win Win Precision Technology is trading at a P/S ratio lower than its industry peers. If revenue continues to shrink, the P/S ratio may decline further, which could disappoint investors. Shareholders are currently accepting this low P/S, as they seem pessimistic regarding future revenue.

The Road Ahead

While the recent surge in share price is positive, the company’s low P/S ratio, driven by declining revenue, suggests caution going forward. The P/S ratio reflects investor sentiment and expectations for future growth. To make an informed decision, it’s essential to consider other vital risk factors. Investors should also be aware of three warning signs associated with Win Win Precision Technology.

It’s important to find the right company with strong fundamentals, not just the first idea that comes across. Taking this into account, prospective investors can assess whether the company is undervalued or overvalued with a detailed analysis of its financials, including fair value estimates, potential risks, dividends, insider trades, and its overall financial condition.

Disclaimer: This article is based on historical data and analyst forecasts and is not financial advice. It does not constitute a recommendation to buy or sell any stock. Simply Wall St has no position in any stocks mentioned.