Wuxi Autowell Technology: Strong Insider Ownership Signals Growth Potential

Recent analysis of Wuxi Autowell Technology Co., Ltd. (SHSE:688516) indicates a strong alignment between the company’s leadership and its shareholders. This positive dynamic is highlighted by significant insider ownership, suggesting that those at the helm have a vested interest in the company’s continued success.

Key Findings

- Insider Ownership Dominates: Insiders, including the CEO, hold a substantial 47% ownership stake in the company. This indicates a confidence in the company’s trajectory and a direct link to the company’s market performance.

- CEO’s Bullish View: The CEO of Wuxi Autowell Technology is identified as the most bullish insider. This positive sentiment likely contributed to the company’s stock gain last week.

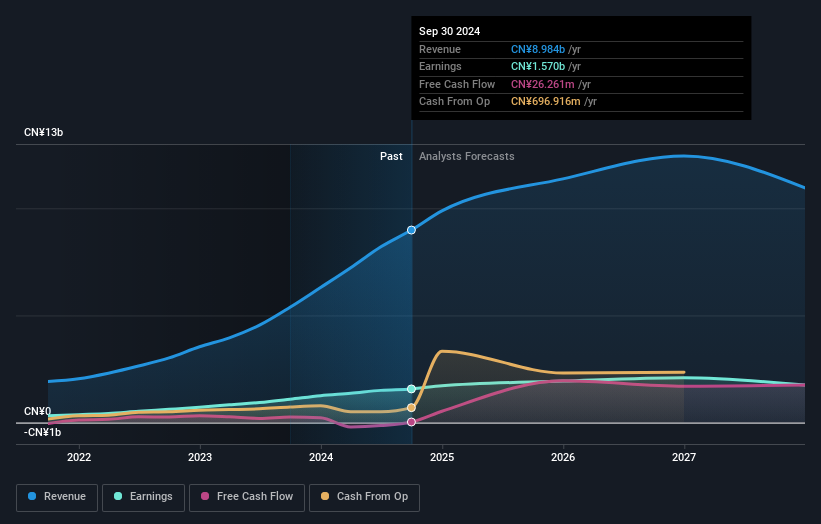

- Stock Performance: The company’s stock experienced an 8.2% increase last week, reaching a market capitalization of CN¥14 billion.

- Institutional Investors: Institutions own a considerable 17% of the company. Their investment suggests that they like the stock.

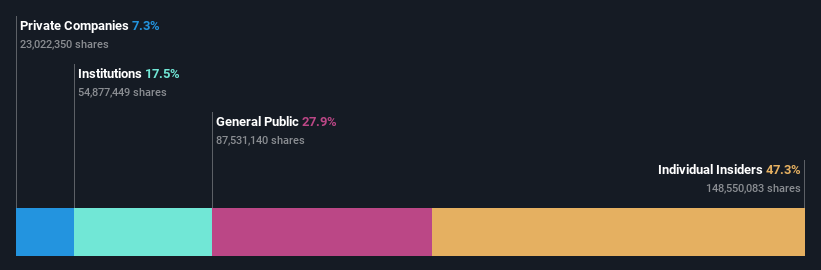

Ownership Breakdown

Significant insider ownership could drive company decision-making. The top four shareholders control more than half of the company, which implies that this group has considerable sway over the company’s decision-making.

Important Shareholders

The ownership structure of Wuxi Autowell Technology includes:

- Insiders: 47%

- General Public: 28%

- Institutional Investors: 17%

- Private Companies: 7.3%

Conclusion

The strong insider ownership at Wuxi Autowell Technology suggests a positive outlook as this alignment of interests suggests a level of optimism and confidence in the company’s future.