Wuxi Autowell Technology: Insider Ownership and Stock Performance

Recent data indicates a significant level of insider ownership at Wuxi Autowell Technology Co., Ltd. (SHSE:688516). This can be a positive sign for investors, as it suggests that those closest to the company have a vested interest in its growth and profitability. The CEO of Wuxi Autowell Technology is the most bullish insider. The stock value gained 8.2% last week.

Key Insights:

- Significant insider ownership suggests alignment of interests.

- A total of 4 investors have a majority stake with 51% ownership.

- Institutions own 17% of Wuxi Autowell Technology Ltd.

- Insiders own a large portion of the company.

This analysis examines the ownership structure of Wuxi Autowell Technology, a company that manufactures and sells automation equipment for various industries in China.

Institutional Ownership

Institutional investors, who typically compare their returns to market indexes, already hold shares in Wuxi Autowell Technology. This indicates that analysts at these institutions have assessed the stock positively. However, as with any investment, there is always a risk that market sentiment changes.

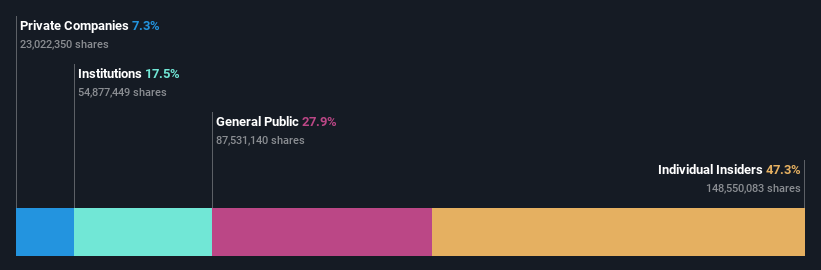

Ownership Breakdown

- Insiders: Insiders, including the CEO Zhiyong Ge (27% ownership) and Chief Technology Officer Wen Li (18%), collectively hold a substantial 47% stake in the company. This significant ownership suggests a strong alignment between the company’s leadership and shareholder interests.

- Institutions: Institutional investors own 17% of the company.

- General Public: The general public holds 28% of the shares.

- Private Companies: Private companies own 7.3% of the stock.

Impact of Insider Ownership

Insider ownership can be a positive indicator, as it demonstrates that those in leadership positions believe in the company’s future. This alignment can lead to better decision-making and a greater focus on long-term value creation, especially in a company of this size.

It is worth noting that insider ownership can sometimes make it more difficult for other shareholders to hold the board accountable.

Where to Find More Information

Investors interested in a deeper dive should consider the following:

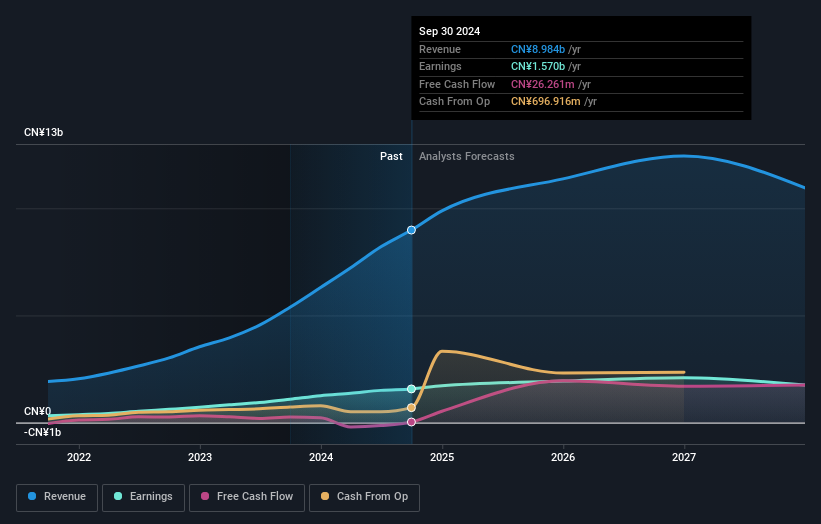

- Analysts covering the stock, and their forecasts

- Potential risks

Disclaimer: This article is based on historical data and analyst forecasts and does not constitute financial advice. It is not a recommendation to buy or sell any stock. Always conduct thorough research and consider your financial situation before making investment decisions.