Wuxi Taclink Optoelectronics Stock Analysis

The stock price of Wuxi Taclink Optoelectronics Technology Co., Ltd. (SHSE:688205) has experienced a significant correction, retreating by 30% in the last month. However, this decline hasn’t erased the positive performance of the past year, with the stock still up 76%. Investors are keeping a close eye on the company’s revenue growth.

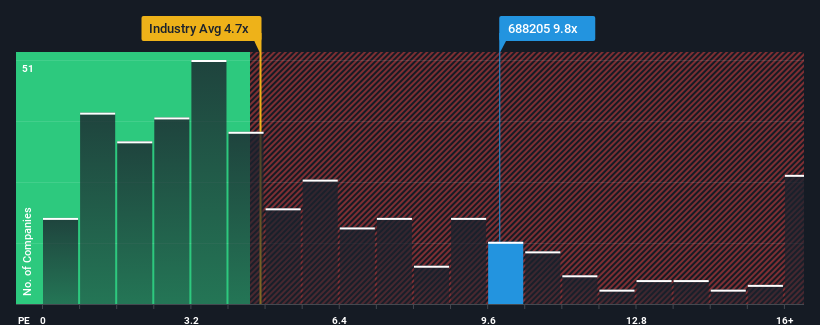

Despite the recent price drop, Wuxi Taclink Optoelectronics Technology maintains a price-to-sales (P/S) ratio of 9.8x. This figure is notably high when compared to the Chinese Electronic industry average, where nearly half of the companies have a P/S ratio under 4.7x. This difference warrants further analysis.

Recent Performance and Revenue Growth

Wuxi Taclink Optoelectronics Technology has demonstrated strong revenue growth in recent times, outperforming many of its peers. This robust performance is likely a key factor driving the high P/S ratio, as investors anticipate continued growth. According to analysts, revenue is expected to grow by 37% over the next year. This contrasts with the projected 26% growth for the industry, indicating a promising outlook for the company.

In the last year, Wuxi Taclink Optoelectronics Technology saw its revenue increase by 25%, and over the past three years, the company has achieved a cumulative revenue growth of 19%. This solid revenue performance contributes to the company’s valuation.

Implications of the P/S Ratio

The high P/S ratio suggests that investors are willing to pay a premium for Wuxi Taclink Optoelectronics Technology stock, anticipating substantial future growth. The company’s superior revenue outlook is a significant contributing factor to its high P/S. Unless there’s a change in these conditions, the elevated P/S is expected to remain.

Investment Considerations

While the P/S ratio can be a useful metric, it shouldn’t be the sole basis for investment decisions. There are potential risks to consider. Investors should also be aware of 2 warning signs for Wuxi Taclink Optoelectronics Technology.

Disclaimer: This article is of a general nature and should not be considered financial advice. It is based on historical data and analyst forecasts, using an unbiased methodology. Simply Wall St has no position in any stocks mentioned.