Understanding Wuxi Xinan Technology’s Valuation

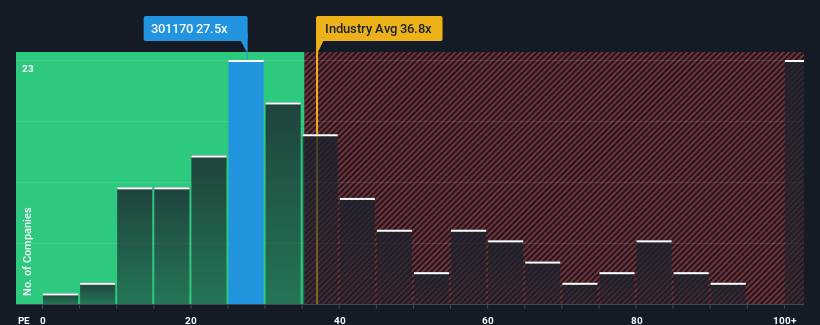

Wuxi Xinan Technology Co., Ltd. (SZSE:301170) currently has a price-to-earnings (P/E) ratio of 27.5x. This might seem attractive compared to the broader Chinese market, where many companies have P/E ratios significantly higher. However, a low P/E ratio isn’t always a sign of a bargain; it requires further investigation.

One potential explanation for Wuxi Xinan Technology’s relatively low P/E is its recent financial performance, which has been lackluster. If a company’s earnings are declining, investors may be pessimistic about its ability to outperform the market in the near future. As a result, the stock might be undervalued.

To gain a comprehensive understanding of Wuxi Xinan Technology’s financial state, consider reviewing a detailed report that examines its earnings, revenue, and cash flow.

Growth Metrics and the Low P/E

Wuxi Xinan Technology’s P/E ratio is typical of a company anticipated to experience limited growth and possibly underperform the market. Last year, the company experienced a disappointing 21% decline in earnings per share (EPS). Over the past three years, EPS has fallen by 6.7%. This recent earnings performance is certainly undesirable.

When evaluating this medium-term earnings trend against the market’s projected one-year expansion of approximately 37%, the contrast is stark. Consequently, the company’s P/E ratio currently falls below that of most other companies.

The low P/E ratio suggests that investors may have concerns that shrinking earnings could result in an unstable P/E over a longer time frame. This could lead to shareholder disappointment.

If the company doesn’t improve profitability, the P/E may go even lower.

Key Takeaways and Investor Outlook

The P/E ratio provides an insight into the market’s view of a company’s overall health. In the case of Wuxi Xinan Technology, the shrinking earnings contribute to its low P/E.

Generally, investors do not see enough potential for profit improvement to justify a higher P/E. Unless the recent conditions change, this will continue to suppress its share price.

Before making an investment decision, investors should be aware of any warning signs. It may be possible to find a better investment option.

Disclaimer: This article provides commentary based on historical data and analyst forecasts only using an unbiased methodology and is not intended as financial advice. It does not constitute a recommendation to buy or sell any stock.