Zhejiang Dragon Technology’s Shares Lagging the Market

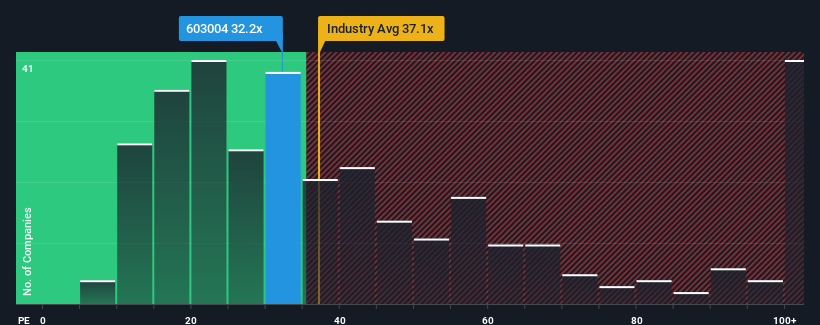

Zhejiang Dragon Technology Co., Ltd. (SHSE:603004) currently has a price-to-earnings (P/E) ratio of 32.2x. This might seem like a buying opportunity compared to the Chinese market, where the median P/E is above 39x and some companies trade at P/Es exceeding 75x. However, a closer look is necessary to understand the reasons behind this lower valuation.

One factor to consider is the recent performance of Zhejiang Dragon Technology. Over the past year, earnings have declined, which could be a cause for concern. This might lead investors to believe that the company’s disappointing earnings will continue or worsen, thus suppressing the P/E ratio. If you are optimistic about the company, it may be a good time to consider the stock.

To grasp the complete picture, consider a free report on Zhejiang Dragon Technology’s earnings, revenue, and cash flow. This report will help you observe the company’s performance and how the recent trends will set the company in the future.

Analyzing Zhejiang Dragon Technology’s Growth

A low P/E ratio, such as the one seen in Zhejiang Dragon Technology, is often justified when a company’s growth lags behind the market. Examining the company’s past performance, earnings per share (EPS) declined by 27% last year. This has dragged down the three-year period, which still managed to achieve a decent 27% overall rise in EPS. This indicates the company has generally succeeded in growing earnings over that time, despite some fluctuations.

When we compare it to the market, which is estimated to grow by 37% in the next 12 months, the company’s momentum appears weaker based on recent medium-term annualized earnings results. This discrepancy explains why Zhejiang Dragon Technology is trading at a lower P/E ratio than the market. Due to this information, several shareholders were apprehensive about maintaining their holdings, believing the company would continue to underperform the market.

Understanding the Implications of the P/E Ratio

While the price-to-earnings ratio alone isn’t a foolproof indicator of whether to sell a stock, it can offer valuable insights into a company’s future prospects. As anticipated, the analysis of Zhejiang Dragon Technology reveals that the three-year earnings trends contribute to its low P/E, as they appear less favorable than current market expectations. Investors currently believe that the likelihood of significant earnings improvement is not high enough to justify a higher P/E ratio.

Investors should take a look at the company’s investment analysis. You may learn Zhejiang Dragon Technology is showing a warning sign. If you’re unsure about the strength of Zhejiang Dragon Technology’s business, explore the list of stocks with solid business fundamentals for other companies. Valuation is complex, but a more detailed analysis can determine if Zhejiang Dragon Technology might be undervalued or overvalued, featuring fair value estimates, potential risks, dividends, insider trades, and financial condition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.