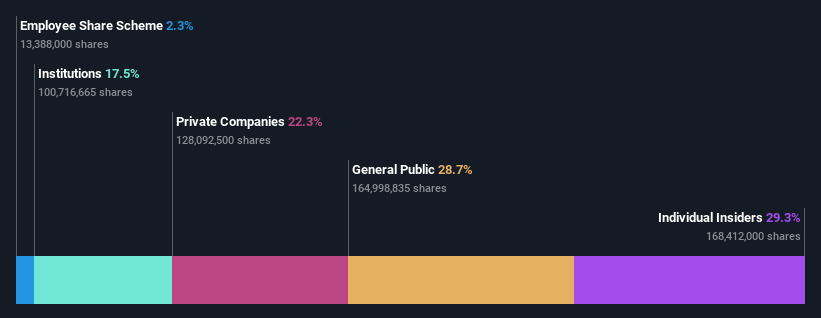

If you’re trying to figure out who really calls the shots at Zhejiang Huangma Technology Co., Ltd. (SHSE:603181), a deep dive into the shareholder structure is essential. The most recent data paints a clear picture: insiders hold considerable sway, with their interests closely aligned with the company’s growth.

The breakdown reveals a significant insider presence—individuals owning 29% of the company. This group stands to gain or lose substantially based on the company’s performance, as evidenced by the recent CN¥610 million rise in market capitalization.

Institutions also play a role, controlling 17% of Zhejiang Huangma Technology. The fact that institutional investors are involved suggests they’ve assessed the stock’s value positively.

Wei Song Wang is the largest shareholder with a 20% stake. Zhejiang Huangma Holding Group Co., Ltd. holds the second-largest share at 10%, while Shaoxing Shirong Baosheng Investment Management Partnership Enterprise (Limited Partnership) possesses approximately 7.7% of the company’s stock.

A closer look at the shareholder base reveals that the top seven shareholders account for around 53% of the shares. This indicates a balance of influence between significant and smaller shareholders.

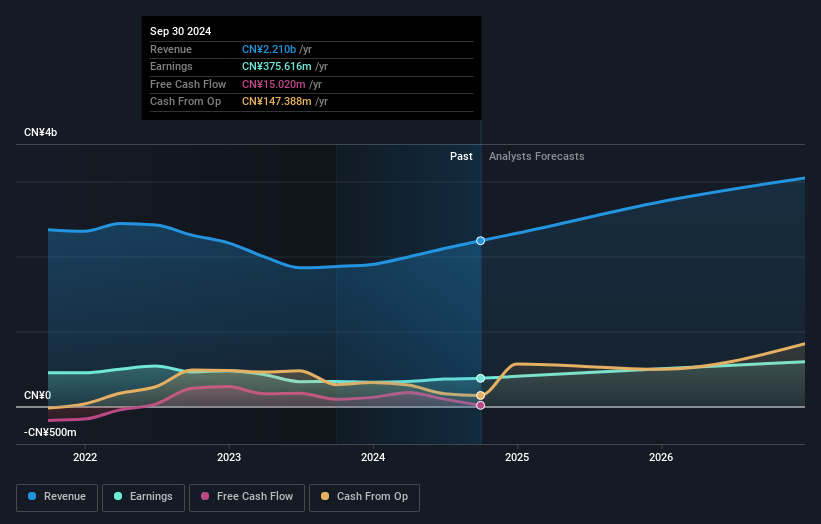

It’s also worth considering the company’s earnings history.

Insider ownership often reflects a commitment to the company’s long-term success, however, it can also concentrate power in the hands of a few.

Zhejiang Huangma Technology Co., Ltd.’s market capitalization is around CN¥7.0 billion, with insiders holding approximately CN¥2.0 billion worth of shares. The general public holds 29% of the company.

Private companies hold 22% of the shares. Further investigation into the ownership of these private companies may offer added insights.

To fully understand Zhejiang Huangma Technology, it’s necessary to consider additional factors, like the one warning sign the company has.

Disclaimer: This analysis is based on data from the past twelve months. This is not financial advice.