Zhejiang VIE Science & Technology: Individual Investors at the Forefront of Recent Market Shift

Individual investors in Zhejiang VIE Science & Technology Co., Ltd. (SZSE:002590) experienced the sharpest impact during last week’s CN¥452 million decrease in market capitalization. This analysis explores the company’s ownership structure to understand the implications for its shareholders.

Key Findings:

- Individual Investor Dominance: A substantial 44% of Zhejiang VIE Science & Technology is held by individual investors, highlighting their significant influence on the company’s direction and their exposure to market fluctuations.

- Majority Stakeholders: A concentrated group of five investors collectively controls a majority (50%) of the company, potentially giving them considerable sway in management decisions.

- Market Impact: Following a 6.4% drop in share price last week, individual investors bore the brunt of the losses.

Ownership Breakdown

Understanding the ownership distribution provides insights into stakeholder influence. Institutions, which typically benchmark their investments against major indexes, hold a smaller portion of the shares. This might indicate that many institutions haven’t extensively considered the stock, although some have invested.

Institutional Investors: Institutions hold a relatively small portion of the shares. The potential for increased institutional investment exists if the company’s performance strengthens.

Major Shareholders: The largest shareholder is Wanan Group, with 42% of shares outstanding. Feng Chen, who is the second-largest shareholder, also serves as Chief Executive Officer. Approximately 50% of the company is controlled by the top five shareholders, suggesting considerable influence.

Insider Ownership: Insiders possess a significant ownership stake, holding CN¥653 million worth of stock in the CN¥6.6 billion company. This can indicate alignment between the board and other shareholders. However, it’s worth noting that a private company related to some insiders holds 43% of the shares.

Public and Private Ownership: Individual investors hold a substantial 44% stake, while private companies hold a significant 43% of the shares.

Next Steps

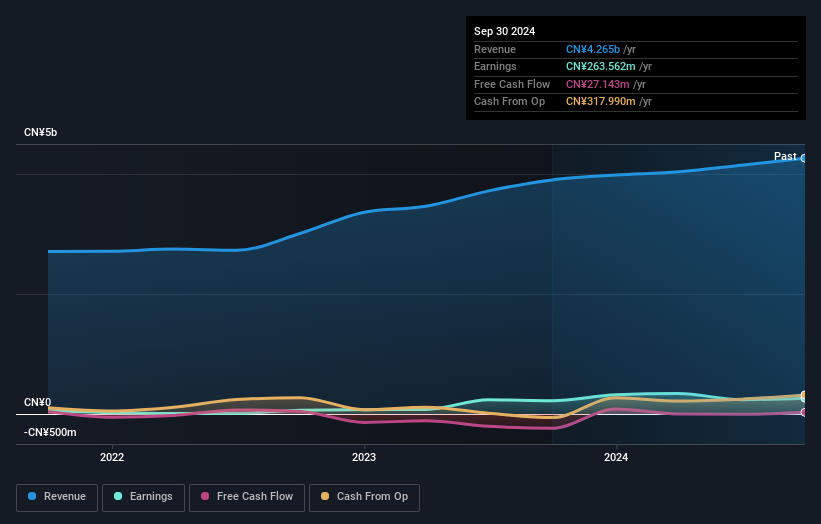

This analysis highlights the ownership structure of Zhejiang VIE Science & Technology and its implications. For a comprehensive understanding, further evaluation of the company’s past performance, financial health, and analyst recommendations is necessary.

This article is based on data up to February 28, 2025.