Zhejiang ZUCH Technology’s Shares Leap 32% – A Closer Look at the P/E Ratio

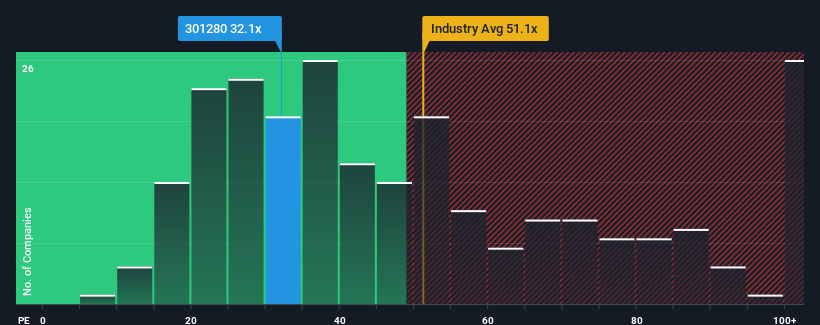

The stock of Zhejiang ZUCH Technology Co., Ltd (SZSE:301280) has performed well recently, experiencing a notable 32% increase in the last month and a 68% jump over the past year. Despite this surge, the company’s price-to-earnings (P/E) ratio of 32.1x suggests a potentially bullish outlook, especially when considering that the median P/E ratio for Chinese companies is above 38x, and many exceed 74x.

To determine if this lower P/E ratio is justified, a deeper analysis is needed. Zhejiang ZUCH Technology has seen its earnings increase even as the broader market’s earnings have declined. This could indicate market expectations of a substantial decrease in the company’s strong earnings, which may be repressing the P/E ratio, hence the potential bullish signal. If you are optimistic about the company’s future, the current share price could be an opportunity.

Growth Potential

A company’s P/E ratio is considered reasonable if it is expected to underperform the market. Over the past year, Zhejiang ZUCH Technology’s bottom line saw a 20% increase. Despite this recent growth, the company’s three-year earnings per share (EPS) have decreased by 3.4%, which may cause concern among shareholders. However, analysts predict a 40% increase in EPS in the coming year. With the broader market expected to grow by 37%, Zhejiang ZUCH Technology is positioned to achieve comparable earnings. This makes the company’s lower P/E ratio somewhat unexpected, potentially indicating that investors are not fully convinced about the company’s ability to meet future growth projections.

Understanding the P/E Ratio

The recent share price increase did not significantly raise Zhejiang ZUCH Technology’s P/E ratio, keeping it below the market median. The P/E ratio is useful in assessing market sentiment toward a company. Given the company’s anticipated growth, which aligns with the market average, a lower-than-expected P/E ratio might signal underlying risks. These risks can include possible earnings instability, which typically adds further support to the share price. Investors should also be aware of other potential risks, such as warning signs identified in the company’s financials.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.